The world of investing can seem quite daunting at times. How do you know what products to invest in, or when to sell an asset? Often, a well-thought-out investment strategy can help to simplify your decision making and focus your attention on your investment goals.

There are many investment strategies out there and one, made popular through the likes of Warren Buffett and Benjamin Graham, is value investing.

The value investing strategy

Value investors seek to maximise returns by finding stocks in the market that they consider to be undervalued. Value investors tend to follow a set of rules and principles that underpin the value investing strategy. Below are four rules that the typical value investor follows.

Rule #1 – Invest in companies, not stocks

When a value investor purchases a stock, they treat their investment as if they were buying the entire company. The philosophy behind value investing is to invest in companies that have a clear direction, are well established, and are easy to understand. Value investors tend to favour businesses that have proven to be consistently profitable, such as ‘blue-chip‘ companies and companies involving consumer staples.

Rule #2 – Buy and hold

Another key principle of value investing is to think long term. Unlike day traders, who often buy and sell stocks on the same day, value investors purchase stocks with the intention of holding on to the, for years or sometimes even decades. The theory behind investing over a long period is it should allow investors to weather the ups and downs of the market. Stocks in the short term tend to be quite volatile but history has shown us that over long periods of time the value of stocks generally rise.

Rule #3 – Ignore the crowd

When the market reacts to good or bad news this generally results in stock price movements, this is known as the market sentiment. Sometimes when market sentiment is low, value investors see this as an opportunity to profit from what they might deem as ‘market overreactions’. For example, if the market takes a downward turn a true value investor wouldn’t panic. If they’ve done their research and have carefully selected their stocks, they might instead purchase more stocks while prices are low. The fundamentals of the companies they have invested in should be reason enough to hold rather than sell.

Rule #4 – Always invest with a margin of safety

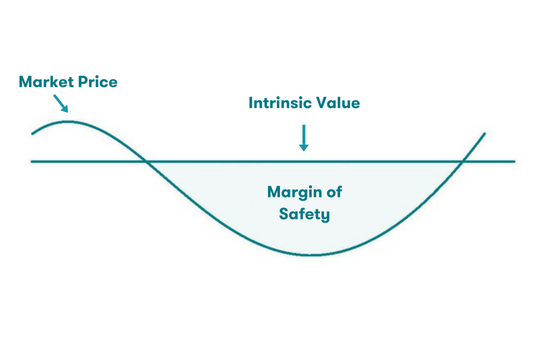

Before a value investor purchases a stock it generally has to pass through the margin of safety test. This means that the market value of a stock has to be below the company’s intrinsic value. Although, not only below the intrinsic value but significantly below it, as this provides a buffer in case the stock doesn’t perform as anticipated. Buying below the margin of safety helps to minimise the risk for the investor. Here’s what the margin of safety looks like:

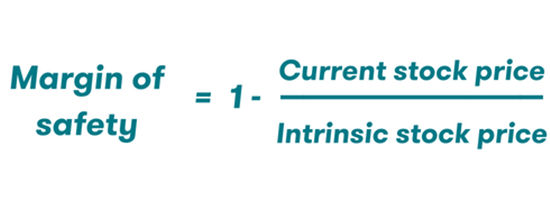

To determine the intrinsic value of a company, value investors tend to perform a highly detailed analysis of the business. This often involves applying several different financial ratios, assessing the company’s existing assets and liabilities, and factoring in the potential for future earnings and growth.

When the investor has decided upon a company’s intrinsic value, the margin of safety formula can be applied.

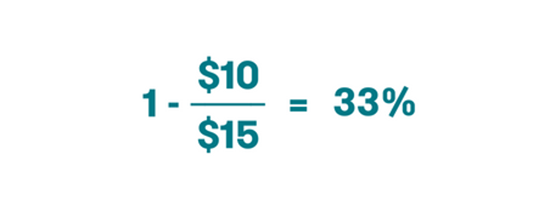

The margin of safety is expressed as a percentage. Below is an example:

Generally, the higher the margin of safety, the better.

But there are some limitations

There are some criticisms of the value investing strategy that revolves around the margin of safety principle. When applying the margin of safety formula it is assumed that the investor has accurately determined the intrinsic value of the company. However, measuring the intrinsic value is easier said than done, and is also largely subjective.

Also, value investors don’t tend to get swept up in investment fads or trends and generally stick to ‘blue-chip’ stocks. However, this method can create a blind spot for fast-growing start-ups that may not yet be profitable but have the potential to go gangbusters.

Take-home message

We’ve only just scratched the surface of value investing; before applying this strategy be sure to do some thorough research. There are plenty of great online resources and books available for those looking to learn more.

Regardless of the investment strategy that you adopt, the important thing is to have one. A clearly defined investment strategy can take the guessing out of the game and allow you to focus on your investment goals and needs.

Share this article