Investing For Retirement In Your 20s

According to The Grattan Institute’s 2019 Generation Gap Report, younger Australians are growing their wealth at a much slower rate than those who are older. Additionally, the troubled superannuation industry may not be able to support young Australians to have a comfortable retirement.

For someone in their twenties, information like this can be a little depressing, but you’ve got the one thing everyone else covets: time. Regardless of your method, the one thing that grows money is time. Your job now is to figure out the best way to optimise that growth. Good financial habits now will set you up for retirement – and they’ll certainly make pre-retirement much easier too.

The best thing about investing for retirement when you’re young is that you don’t need to start big. You can start with a small initial amount, drip-feed that account consistently and then just let time work its magic.

Sound too good to be true? Let me explain what many people wish they knew when they were your age, because heeding the advice below could change the shape of your future life.

Understand the difference between saving and investing

The key difference between the two is that saving involves setting aside a stash of money that you keep adding to. Generally, people use a bank account to store their cash, and besides hard work, the best you can hope for is a decent interest rate to grow your money.

Investing, on the other hand, is when you buy assets like stocks, bonds, gold, or property and hope these assets will appreciate in value and give you a better return than just saving.

People save money instead of investing it because it’s low risk. Unless something happens to your financial institution, your money is safe.

Investing means taking a little more risk for hopefully more reward. The reason people get scared of investing is that investments go up and down in value constantly and absolutely no one can guarantee a return.

There’s a raft of literature on investing to maximise returns and minimise risk, but the number one thing to remember is that money that you invest is money that you’re taking a risk with. Ideally, it’s a calculated, well-thought out risk. But it’s still a risk. So if you’re going to invest, think of that money as separate from a pool of savings that you can access whenever you need to.

→ Related story: What to do before investing in a recession

Know the difference between active investing and passive investing

Active investing involves trusting your money to a fund manager who uses their investment skills to try and beat the market return. The philosophy of active management is that you get a chance to beat the market return if your fund manager gets their market timing and stock selection right.

Passive investing involves buying assets to hold over the long term. Unlike active investors, passive investors aren’t looking to profit from short-term price fluctuations or market timing.

My personal experience has taught me that passively investing in a properly diversified portfolio (more on that later) is the best way to minimise risk and grow wealth over the long term. But if you’re starting out, it’s important to do your research because everyone’s circumstances are unique.

Additionally, make sure you understand the difference between trading and long-term investing. Trading is a short term strategy that’s all about timing the market, and it’s incredibly risky. Long-term investing for retirement is totally different.

Take advantage of time in the market

The market zigs one day and zags the next, and that’s why commentators, traders, and investors are always on their toes. However, if you look at any graph charting the stock market, the overall trend has been upwards.

Unfortunately, many people start investing too late and don’t have the time for the general trend to reveal itself. If you’re in your twenties though, that problem doesn’t exist. You have time for your investments to grow, and a portfolio of diversified shares and bonds has historically offered excellent investment returns compared to leaving all of your savings in the bank.

Here’s a video explaining the benefits of investing early.

Investing early increases compound returns

The magic of compound returns allows not only your initial investment to grow, but also increases the value of reinvested profits.

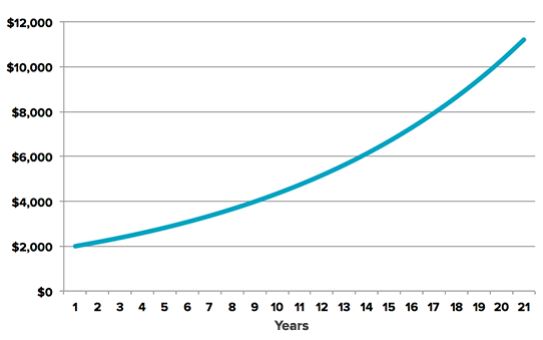

For example, if you earn a 9% capital gains on your initial $2,000 investment in the first year and your profits are reinvested, you would then be earning returns on $2,180 in your second year (initial $2,000 and additional $180 reinvested).

As shown in the chart below, compounding can make a huge difference to your final balance over a longer period. Assuming a 9% growth per year after tax, the initial $2,000 investment would end up being $3,077 after 5 years, $4,735 after 10 years and $11,209 after 20 years with compounding.

When investing in shares or bonds, you’ll sometimes receive dividends and distributions. It’s tempting to cash out these returns, but you’ll get more compounding returns by re-investing these profits.

Because the impact of compounding gets bigger with time, the earlier you start investing, the better the result. Investing $2,000 at 25 as opposed to 35 could double the profit you make by the time you’re 50.

Consistent investing is key

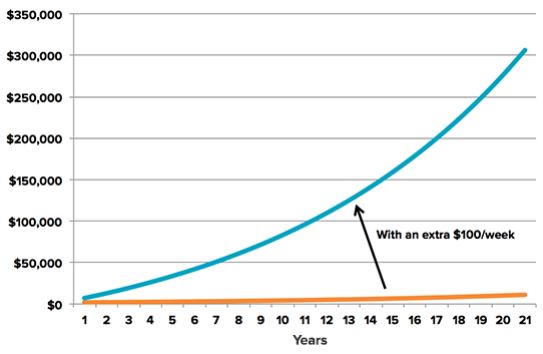

If you start investing in your twenties, a smart strategy is to start with an initial amount that you don’t need and won’t miss, and then put smaller, regular amounts into that account. It could be $50 a week, or $100 a month. The key is consistency.

For example, if you start with a balance of $2,000 and add $100 per month for 30 years, based on an after-fee market return of 7% p.a. you would have $522,672 after 30 years. If you only started depositing $100 dollars 15 years after opening that initial account, you’d only have $140,668 by the end of that 30 year period.

Regular investing also helps you take advantage of something called dollar-cost averaging to help reduce your risk. Dollar-cost averaging is a strategy to reduce the impact of volatility in the market by investing smaller amounts over time.

Because the markets rise and fall over short periods, it can be hard to pick the right time to be buying and selling, so investing regularly can help balance out how much you pay for your investments.

Diversify your investments

Many people invest by just picking a few stocks, which is ideal. If just one of the companies falls over, a significant portion of your portfolio might be lost. Often, investors make an emotional decision to sell at this point, negating any potential long-term gains.

If you’re investing for retirement, a better strategy is diversifying your investments. One way to do this is through exchange traded funds (ETFs). These enable you to spread the risk across hundreds or even thousands of companies so you are not overly exposed to any one business.

The concept of ETFs can be tricky to understand, but essentially when you invest in an ETF, you essentially get access to shares in thousands of companies like Apple, Google, BHP, Woolworths and Westfield so you don’t have to worry about picking the wrong stock.

There are other types of ETFs that can give you access to lower-growth ‘safer’ investments like gold and bonds. If you hold different types of ETFs or different kinds of assets (this is called portfolio diversification), you spread your risk. When the price of one asset drops, it’s likely another one will rise, and this minimises your loss.

Another thing to note is no matter when you start investing, you should keep your fees low, so that you’re giving your money the optimal chance to grow.

With all of the above said, investing in your twenties can still be a bit overwhelming. In recent times however, technology has taken care of this problem, and there are now companies – like Stockspot – that help you create a properly diversified portfolio and allow you to set and forget.

Using technology like this means you can get on with the fun and exploration of being in your twenties, while your investments chug along in the background, working hard to make your retirement a whole lot sweeter.

Main image source: ShutterStock (Skyfly)

Try our Investor Hub comparison tool to instantly compare Canstar expert rated options.