Opinion: Canstar’s General Manager of Wealth, Josh Callaghan

Heading into Christmas last year, it felt like the only thing that the media wanted to talk to me about was Bitcoin. This exciting cryptocurrency was capturing the hearts and minds of the general public, and it wasn’t long until we started seeing its price reported in the market updates of many national media outlets.

It’s now been nine months since Bitcoin’s stratospheric rise in price and chatter, so I thought it might be a good time for us to review what’s happened since and reopen the book on Bitcoin.

Bitcoin’s price

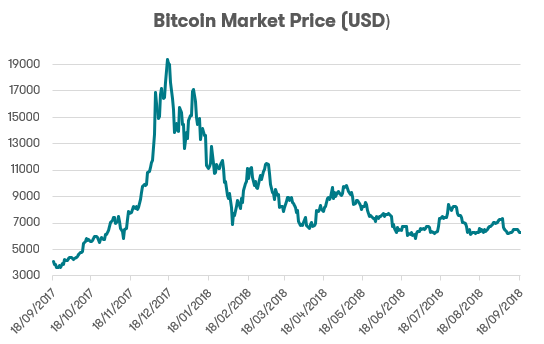

First let’s take a look at the price. For simplicity of picking up the data, I’m just going to report in US dollars but the AUD chart looks much the same.

Prepared by Canstar. Source: Coindesk.

This time two years ago, Bitcoin was trading at around $600. Halfway through December 2017 it got up to the famous $20,000 mark, and after crashing this February to around $7,000 it’s more or less travelled sideways ever since. In fact, you might say that since February the currency has somewhat stabilised given its range of trading has effectively been between $6,000 – $10,000, and averaging around $7,500.

The interesting thing about this, in terms of investing, is with this sort of price movement it is starting to look like a mature product. However, the remarkable thing about the price of Bitcoin is that there isn’t a fixed number of coins. Unlike shares in a company where there are only a certain number on offer, Bitcoins are continually mined. Therefore, a stabilised price is actually adding value to the market capitalisation of Bitcoin with every new coin mined. To break it down simply, think of it in terms of supply and demand. Typically, the value of an item reduces as there is greater supply, however Bitcoin has managed to maintain its value despite a continual supply.

There are many possible reasons the price of Bitcoin has declined since topping out in December. But the thing that leaves me wary about Bitcoin, comes down to the fundamentals of the technology, specifically the cost of mining a coin and the time it takes to settle a transaction.

Bitcoin #FAIL

The promise of Bitcoin was to provide lightning fast, near-free transactions without banks, central authorities or boundaries. Therefore, for me, the speed and cost of transactions has been my reference point to test if the technology is delivering what it had promised.

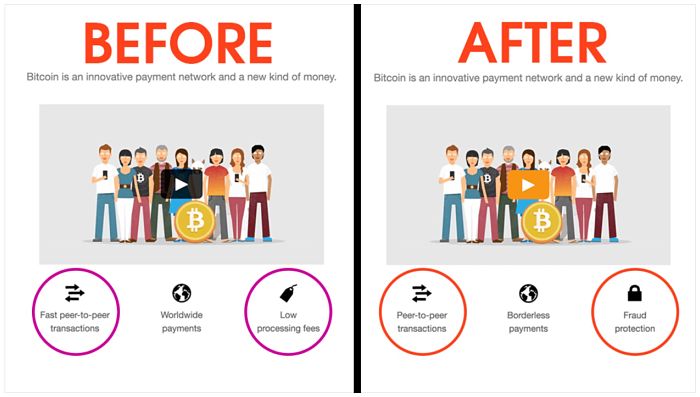

HOWEVER, in late 2017/early 2018, as transaction speeds were grinding to a halt and the transaction costs were skyrocking, the Bitcoin community started trying to redefine what its purpose was. Even Bitcoin.org subtly changed its homepage to position the coin away from its original promise. They subtly removed the reference to ‘fast’ transactions and completely removed their claim of low processing fees.

Bitcoin’s future

What is the future of Bitcoin? This is the critical question that anyone considering buying should think about asking, because the answer to this question may determine how you value it. Personally, I don’t know the answer. Right now, it’s a slightly faster but possibly more expensive way of transferring money across borders without the middle men. Although, if you want to use fiat currencies the middle men still exist in the form of crypto exchanges.

Sure, you can buy Bitcoin and use it at a lot more places now, but I’m not sure I’d want the value of my next coffee going up and down by 20-40% each time.

Finally, with the proliferation of other alternative coins, it’s hard to see the future clear enough to judge Bitcoin’s value.

Conclusion on Bitcoin

For me, it’s a fascinating experiment in markets, consumer trends and market manipulation. At the peak of the crypto boom you couldn’t sit in a tea room without hearing the opinions of an overnight crypto expert. Hopefully, investors have learned from the dramatic rise and fall of Bitcoin, and in future will avoid getting swept up in ‘get-rich-quick’ rhetoric.

During the hysteria in December, I provided readers a potential way of valuing Bitcoin using its market capitalisation relative to other markets. The concept still holds up, so for those interested, you can read that here.

Want to keep on top of market movements and the latest investment news? Follow Canstar Investor Hub on Facebook and X, or you can sign up to our newsletter below.

About Josh Callaghan

About Josh Callaghan

Canstar’s General Manager for Wealth, Josh Callaghan, is the former General Manager of Wealth at Canstar and co-founder of Fintech Queensland. In his role at Canstar, Josh was responsible for the strategic direction, operations and commercial outcomes of the Wealth division, which includes Superannuation and Investments. He has over 19 years of experience in product management, strategy, technology and marketing in the financial services industry.

Share this article