APRA applies speed limit to high debt-to-income loans to keep investors in check

APRA’s new cap on risky loans with high debt-to-income ratios is a commonsense step in safeguarding responsible lending, but is unlikely to impact the mortgage market while interest rates remain at current levels.

From 1 February, the banking regulator, APRA, will limit banks to approving up to 20% of new mortgages to borrowers with a debt-to-income ratio of six times or more.

A debt-to-income (DTI) ratio is the total amount of debt a borrower has, compared to the person’s gross income. APRA considers debt-to-income ratios of six times or more risky.

New cap unlikely to impact how much people can currently borrow

This is a pre-emptive move from the regulator that is unlikely to impact borrowers about to enter the market.

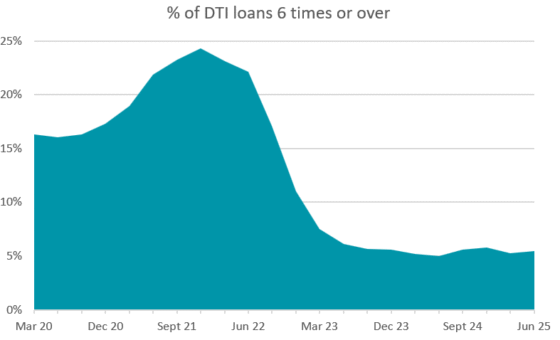

The proportion of new loans with a debt-to-income ratio of six times or more is currently just 5.5% – well below both the new 20% cap and the record high back in late 2021 when over 24% of new loans had a DTI ratio of six times or more.

However, as rates have come down, the proportion of these loans has risen. APRA has also indicated that investors are over-represented in this subset, with the proportion of investor loans with these high DTI ratios sitting closer to 10%.

Source: APRA Quarterly Authorised Deposit-taking Institution statistics for June 2025 quarter, all ADIs, released 11 September, prepared by Canstar.

This change comes on the back of ABS Lending Indicator data that shows investor lending hit a record high of just under $40 billion in the September 2025 quarter – an increase of 18% in just three months.

← Mobile/tablet users, scroll sideways to view full table →

| Value of new lending in September quarter 2025: ABS | ||

|---|---|---|

| Loan type | Value of loans | Quarterly change |

| Owner-occupier | $58.2 billion | +5% |

| Investment | $39.8 billion – record high | +18% |

Source: ABS Lending Indicators September 2025, prepared by Canstar.com.au. Value of new loan commitments based on seasonally adjusted figures.

Higher rates are keeping a lid on debt-to-income ratios, for now

Currently, the higher rate environment, along with APRA’s serviceability buffer rule, which requires banks to stress test a borrower’s finances at rates 3 percentage-points higher than current rates, is the rule that’s keeping a lid on how much people can borrow.

Our analysis shows that a single person earning the average full-time wage can borrow an estimated $544,000. This equates to a debt-to-income ratio of 5.2.

However, if rates fell significantly further, a borrower’s debt-to-income ratio could potentially climb to over 6, even with the serviceability buffer in play.

← Mobile/tablet users, scroll sideways to view full table →

| Borrowing capacity for a single on the average wage | |||

|---|---|---|---|

| Current | If rates fell 1%-pts | If rates fell 2%-pts | |

| Mortgage rate | 5.51% | 4.51% | 3.51% |

| Maximum borrowing capacity | $544,000 | $599,000 | $662,000 |

| Debt-to-income ratio | 5.2 | 5.7 | 6.3 |

Source: Canstar. Based on an owner-occupier taking out a 30 year loan at the average rate of 5.51% and the average wage of $104,807 (ABS full time ordinary-time wage). Assumes minimal expenses, no debts, no dependents. Full notes below.

APRA no stranger to caps

The banking regulator has a range of limits and rules in place to promote responsible lending by the banks, however, many of the previous changes were in response to a current risk, rather than an emerging one.

- December 2014: Investor lending cap – APRA instructed banks to limit growth in investor lending to no more than 10% per year. The cap was removed in April 2018.

- March 2017: Interest-only lending cap – APRA required banks to limit new interest-only lending to 30% of new loans and place tighter scrutiny on interest-only loans with small deposits. The cap was removed in December 2018.

- July 2019: Serviceability buffer changes – APRA increased the serviceability buffer to 2.5%-points. It removed the blanket ‘floor rate’ at which all loans must be stress-tested, which was set at, at least 7%, instead requiring banks to set their own floor rates.

- October 2021: Increased buffer – ARPA increased the serviceability buffer from 2.5 to 3%-points.

- February 2026: Introduction of DTI cap – APRA to introduce a rule to prevent banks from issuing more than 20% of new loans to borrowers with a DTI above 6 times.

Canstar’s data insights director, Sally Tindall says, “APRA has long said loans with debt-to-income ratios of six times or more are risky. Now it’s putting a formal cap on them to set a benchmark for the industry.”

“While the share of high DTI loans is still incredibly low by historical standards, the regulator isn’t willing to sit back and watch it rise.

“At just 5.5 per cent of all new lending, and no more rate cuts in plain sight, this new limit won’t impact the vast majority of borrowers at current rates, but we only have to look back four years to know that this risky type of lending can quickly climb over 20 per cent in a low-rate environment.

“In 2021, almost one in four new mortgages breached this threshold and it put households under enormous pressure when rates started rising.

“Record-high loan sizes and surging investor activity are flashing warning lights. The RBA’s recent rate cuts have poured fuel on the fire, and APRA clearly doesn’t want the market to overheat.

“Debt-to-income caps are just one of a suite of responsible lending guidelines APRA has in place. The real workhorse right now is the 3-percentage-point serviceability buffer, which does far more to rein in borrowing power at higher rates.

“However, rates can drop in the blink of an eye when the economy gets hit by a major curveball. That’s why the regulator has a range of rules to cater for changing conditions. It means they won’t have to scramble if and when the market shifts.

“For anyone planning to take out a mortgage in the coming months, it’s worth running the numbers now. If you’re edging close to six times your income, expect the bank to take a more conservative line.”

How we calculate borrowing power

Calculations are based on the current new owner-occupier variable rate of 5.51%, a loan term of 30 years, annual expenses of $24,000 for singles, 90% of post-tax income available to service the loan and expenses, and a 3.00% interest rate buffer. Tax calculations based on the current financial year, excluding Medicare Levy. Assumes borrowers have no existing debts, minimal expenses and no dependents. Average wage is based on the ABS average full time ordinary time earnings wage of $104,807 p.a. and does not factor in pay rises. Borrowers should seek personal financial advice before deciding how much to borrow and know the actual amount will vary depending on their personal circumstances and between lenders.

This article was reviewed by our Consumer Editor Meagan Lawrence before it was updated, as part of our fact-checking process.

- Fixed rates on the rise as inflation dashes chance of further cash rate cuts

- NAB rules out further cash rate cuts this cycle

- Almost half a million dollars worth of home loans refinanced every minute

- Refinance Home Loan Comparison

- Compare some of the lowest variable home loan rates

- Compare Fixed Rate Home Loans