If you’ve ever applied for credit, you’ll likely have a credit report about you. Find out what is on your credit report and why it’s important to check it.

What is a credit report?

A credit report is a summary of your credit history. For example, it will include information about any credit products you have and whether you’ve made your repayments on time.

Credit reports are created by credit reporting bodies such as Equifax, Experian and illion and are based on information given by credit providers (such as banks and other financial institutions, as well as telco and utility companies) and other sources, such as government agencies.

Your credit report is important because it can be accessed by credit providers when you apply for credit with them. Providers can then use your credit report as part of their decision making to decide whether to approve your application.

What is on my credit report?

Your credit report can include the following information:

- Your personal details including your name, date of birth, gender, address, driver licence number and employer details.

- Your consumer credit accounts, including information about the type of account, the provider, its credit limit and its open and/or close date.

- Your repayment history, including whether you have paid the minimum repayment each month, or whether your repayments were late.

- Overdue accounts, such as any defaults or serious credit infringements.

- Credit enquiries made by a credit provider when you have applied for credit, including the type and amount of credit you applied for.

- Public record information such as court judgments or bankruptcies.

Information will only stay on your credit report for a certain period of time. Timeframes include:

- Current consumer credit obligations – 2 years (from the end of the consumer credit)

- Repayment history – two years

- Default – five years

- Serious credit infringement – seven years

- Credit enquiry – five years

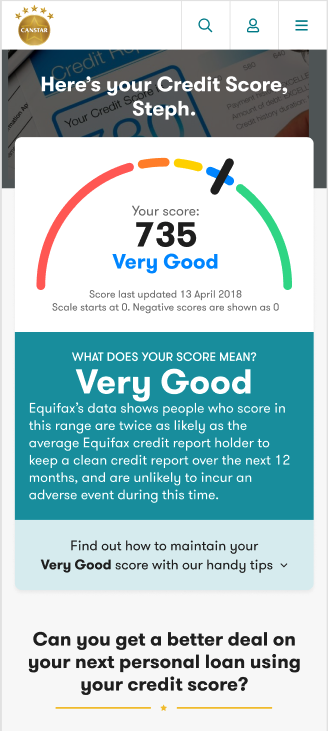

Your credit score is then based on the information in your credit report. This is a number that indicates how creditworthy you are. It usually ranges from zero to 1,000 or 1,200, depending on the credit reporting body.

How can I get my credit report for free?

You can request a copy of your credit report from a credit reporting body, Equifax, Experian or illion. You can get a free copy of your credit report every three months. You can also ask for a free copy if you have been denied credit within the past 90 days or your credit information has been corrected. In other cases, the credit reporting body may charge you a fee to get your credit report, but it shouldn’t be excessive.

These bodies may have different information about you, so it may be worth getting a copy of your report from each body. Different lenders and banking institutions may use different credit reporting bodies (and consider your credit score with them) in assessing your creditworthiness. You may also want to check your credit score regularly.

→ Get your free credit score

What if I see an error on my credit report?

When checking your credit report, look out for any errors. For example, make sure all the loans and debts listed on your report are actually yours and the repayment history is correct.

If you do spot an error, you can contact the credit provider or credit reporting body and ask them to investigate it. If they agree it is incorrect, they can remove the error or get your report amended.

Cover image source: create jobs 51/Shutterstock.com

This content was reviewed by Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article