If you have applied for a product like a credit card or home loan, a lender has likely performed a credit check on you, and in this situation, you may well be wondering – do credit checks affect your credit score?

What is a credit check?

A credit check is an inquiry that a bank or lender makes into your credit report, to assess your reliability as a borrower when you apply for a loan. A credit check will show them your credit score, as well as your history of loans, repayments, defaults, and credit checks that have been run on you for past applications.

There are three major credit reporting agencies in Australia – Equifax, Illion and Experian. If you have ever applied for credit or a loan, it is very likely you will have a credit report with each of them. When you make an application for a loan, a bank or lender may check your credit report with any of the three.

Generally speaking, there are two types of credit checks – soft credit inquiries and hard credit inquiries. These are performed for different reasons and typically, only the latter will affect your credit score.

What are soft credit inquiries?

Soft credit inquiries, otherwise known as ‘soft pull’ checks, or ‘soft pull’ inquiries, are checks that a lender can run to get an overall idea of your financial status without going into depth. These can include period checks by companies you already have credit with, preapproved offers of credit, and checking your own credit report or credit score, amongst other things. Soft pull checks are not the same as applications for credit, and therefore do not have the same impact on your credit as hard pull checks.

What are hard credit inquiries?

A hard credit inquiry or ‘hard pull’ check is a check that a lender typically undertakes when you apply for a product as a loan or credit. A hard credit inquiry allows a lender to take a detailed look at your credit report, to get a picture of your finances, and these kinds of inquiries will be recorded on your credit report. Unlike soft pull checks, lenders require your permission to undertake a hard pull credit check.

Do credit checks affect your credit score?

While soft credit inquiries do not typically affect your credit score, hard credit inquiries do, and when you make too many applications for loans or credit in a short space of time, this can damage your credit score and signal that you may be a risky borrower.

The reason for this is that too many applications for loans in a short space of time can be a red flag to a lender – it might indicate that you are experiencing some degree of financial difficulty and that other lenders are not willing to do business with you.

The lower your credit score and the greater the number of hard credit inquiries on your credit report, the greater the risk you might present to a lender, and the less likely they may be to approve your application for a loan or credit.

How many points do credit checks take from your credit score?

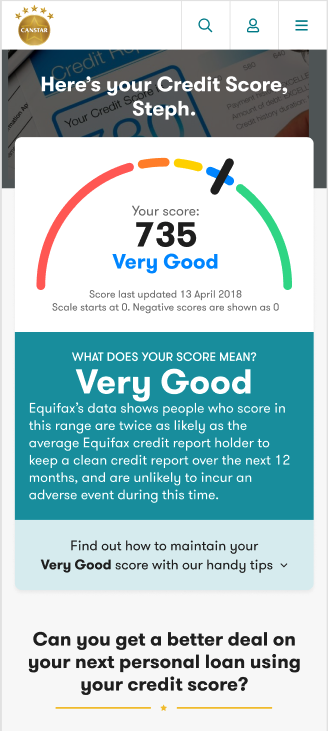

On average, you might expect a hard credit check to take between five to ten points from your credit score. Australia has three major credit reporting agencies – Equifax, Experian and Illion, and the former gives consumers a credit score of up to 1,200, while the latter two give a score of up to 1,000. While a drop like this may seem insignificant as a one-off, several hard credit checks in a row can put a dent in your credit score, and if lenders see a succession of them on your credit report, they may be reluctant to approve you for a loan.

How long do credit checks remain on your credit report?

According to Equifax, hard credit checks may remain on your credit report for two years, although will typically only affect your credit score for one year. Equifax notes, however, that depending on your “unique credit history”, hard inquiries on your credit report may indicate different things to different lenders, and that the presence of recent hard inquiries will indicate that you are in the market for credit, which could affect your creditworthiness in a lender’s eyes.

What are some other reasons your credit score might drop?

Besides too many credit applications, there are other things that can cause your credit score to drop. Other activities that may potentially hurt your credit score include:

- Late repayments on credit cards and loans

- Defaults on payments

- Increasing your credit limit

- Applications for unsecured credit (which can be seen as riskier than secured credit)

How do you check your credit score?

There are a number of websites you can use to check your credit score for free, including Canstar’s free credit score tool. According to the Australian Government’s MoneySmart website, you have a right to get a copy of your credit report for free every three months.

If you’re thinking about applying for a loan product such as a home loan, then you may be wondering about your credit score, including some of the things that can negatively affect it, and some ways you could try to improve it before you apply.

This content was reviewed by Editor-in-Chief Nina Rinella as part of our fact-checking process.

Share this article