New data shows insurance premiums for vehicles and domestic properties in Victoria have skyrocketed as a result of increased theft and burglary, with claims on domestic properties almost doubling those in all other states and territories.

The Insurance Council of Australia analysed data from Insurance Statistics Australia, finding major issuers across Australia had reported distinct increases in claims and premiums in Victoria.

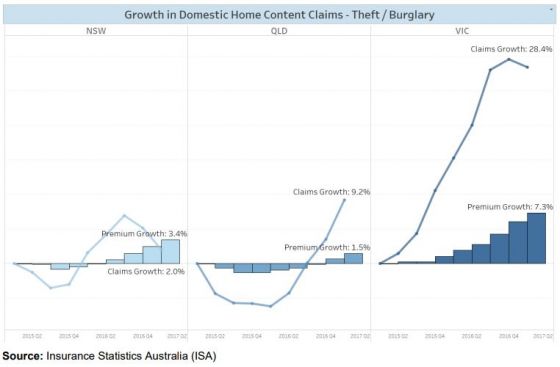

In the past 12 months to the end of Q1 2017 domestic home content claims for theft and burglary in Victoria increased by 28.4%, and the insurance premiums went up by 7.3%, compared to 2015 figures.

That puts Victoria’s claim rates and premiums higher than other states and territories, with claims increasing in Queensland by only 9.2% and average gross premiums by only 1.5%.

Theft and burglary from domestic properties in Victoria resulted in an astounding $92 million in claims over just the last 12 months.

Western Australia came in second for claim totals at $50 million, while the Northern Territory reported only $2 million in claims.

Source: Insurance Council of Australia

More car theft bumping up insurance premiums

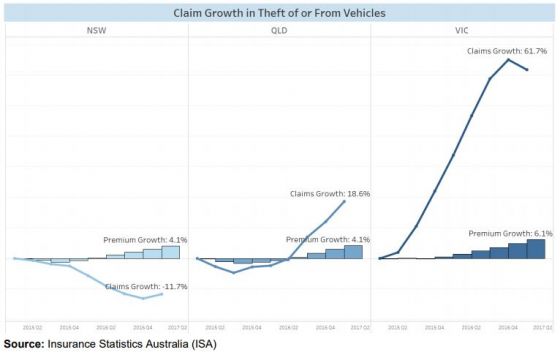

Vehicle theft claims in Victoria have shown a 61.73% increase in the past 12 months to June 2017 when compared to the same period in 2015, well outpacing Queensland (18.63%) and NSW’s (-11.70%) shifts over the same period.

Interestingly, during the same period insurance premiums for vehicles in Victoria have gone up by 6.14%, with NSW and Queensland sitting lower at 4.1%.

Claims totalled $72 million in the past year in Victoria, higher than anywhere else in Australia.

The Northern Territory, ACT and Tasmania all tied for the lowest total claims value at $3 million – significantly lower than Victoria.

But the Insurance Council of Australia said this data about car thefts and resulting claims and insurance premiums may “undersell the totality of the problem”.

“According to the National Motor Vehicle Theft Reduction Council, only 52% of motor vehicle thefts reported to the police result in an insurance claim,” they said.

Source: Insurance Council of Australia

How to reduce the risk of car theft

The RACV has advised motorists in Victoria to consider installing devices such as location monitors to assist them if their vehicle gets stolen or tampered with.

Here are a few other tips from RACV to reduce the risk of becoming a victim to car theft:

- Don’t leave car keys in or around the ignition.

- Try to park in a busy, well-lit area, making sure your car is locked.

- Don’t leave valuables on display.

- Lock your car in a garage or behind gates where possible.

- Keep your licence and fuel card in your wallet, not the glovebox. The owner’s handbook should also be stored elsewhere, as it contains security information and sometimes personal details.

- Raise the level of theft protection on older cars by fitting an Australian Standards approved engine immobiliser, certified to AS 4601. Basic units can be purchased for a few hundred dollars.

- Fit out your vehicle with a good quality alarm. RACV recommends an alarm certified to the Australian Standard AS 3749 to minimise the chance of “false alarming”.

Car theft in Victoria is sky-rocketing with the number of robberies up by 27 percent in just a year. #7News pic.twitter.com/msLiCdpWqm

— 7NEWS Melbourne (@7NewsMelbourne) May 22, 2017

Share this article