The Financial Ombudsman Service (FOS) recorded a record number of disputes this year, largely driven by continued growth in general insurance disputes due to insurance industry issues and the impact of Cyclone Debbie.

The FOS Annual Review shows it received 39,479 disputes in 2017, a 16% increase from last year.

Accounting for about 38% of the overall increase, the number of general insurance disputes was up by 2,612.

Almost one-third (31%) of general insurance disputes involved motor vehicle comprehensive insurance, while 28% involved home building insurance.

The biggest dispute area in 2016-17 though was the 10,973 credit disputes, accounting for 43% of all disputes.

Other disputes received by FOS in 2016-17 included:

- General insurance disputes: 8,756

- Deposit-taking disputes: 1,861

- Payment system disputes: 1,331

- Investments and advice disputes: 1,292

- Life insurance disputes: 1,018

Many disputes involving credit cards and banks

Out of the credit disputes received by FOS, 33% involved credit cards, 24% involved home loans and 19% were about personal loans.

According to the FOS Annual Review, banks were involved in 69% of consumer credit disputes, while some 10,000+ of total disputes involved banks.

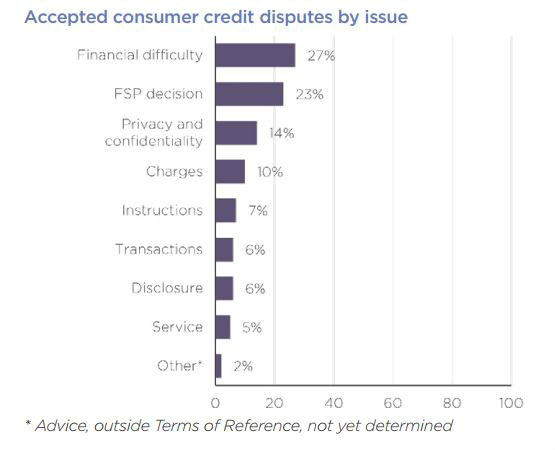

One of the most common credit card disputes for consumers accepted by FOS was about financial difficulty at 27%, while transactions disputes accounted for only 6%.

Source: Financial Ombudsman Service, 2016-2017 Annual Review

Dispute resolution more efficient

According to the FOS, the average time taken to handle disputes has improved with a 13% reduction in 2016-17, but a major challenge has been the significant increase in overall disputes which puts pressure on staff workloads.

In response, FOS has recruited more staff to handle the high volume of complaints.

“This means that people can have their cases resolved more quickly and get on with the rest of their lives,” said Chief Ombudsman Shane Tregillis.

The key focus for FOS ombudsmen handling disputes was on systemic issues, with more than 940,000 customers affected by these issues.

This problem led to significant refunds and other remedies such as amendments to, or removal of, credit listings.

Share this article