Your credit score can be an important consideration when you apply for a loan, and it can be affected by a range of factors. If you’ve found yourself asking ‘why did my credit score drop?’, it could be for one of the reasons discussed below.

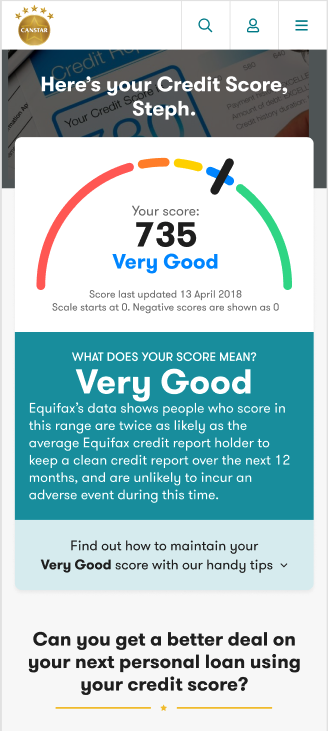

A good credit score can potentially improve your chances of being approved for financial products such as credit cards, personal loans and home loans, and likewise, a low credit score could make being approved for these products more challenging.

If your credit score has recently dropped, there may be a number of reasons why, including some you might not expect. There are also some things you can do to help improve your credit score, if you find that yours has recently dropped.

What causes your credit score to drop?

James Forbes, General Manager Consumer at major credit reporting agency Equifax, told Canstar that there are a number of things that can cause your credit score to drop. The following are some reasons your credit score could decrease:

- Late payments: Making repayments after the due date can have a negative effect on your credit score. One late payment will not have a great impact but a number of late payments in a row can cause a drop.

- Defaults on payments: A consumer default, which is an overdue debt, can be listed on your Credit Report if you have an overdue payment of more than $150, that is more than 60 days overdue.

- Making too many credit applications: Making excessive credit applications for credit products in a short period of time can negatively affect your credit score. This can include credit cards, personal loans, phone accounts and some buy now pay later (BNPL) lenders.

- The types of credit you’ve applied for: Secured credit, like a home or car loan, is less risky than unsecured credit like credit cards and personal loans, and applying for unsecured credit can cause your credit score to drop.

- Increasing your credit limit: Increasing your credit limit can have an impact on your credit score, and according to CommBank, a request for an increased limit may appear on your credit report and reduce the amount of credit that another institution is willing to extend to you.

Some other things that can negatively affect your credit score include court judgments against you, failing to update your address or contact details with credit producers (potentially leading to unpaid bills), and errors on your credit report, caused by incorrect reports from credit providers.

Do late payments always affect your credit score?

According to Clearscore, if your payment is only a few days late, then it is unlikely that it will show up on your credit report. The longer you wait, however, the more likely it is that a late repayment will hurt your credit score.

For instance, if your repayments are more than 30 days late, then it is likely your credit provider will report this to major credit bureaus, resulting in a drop in your credit score. If you have still not paid within 60 to 90 days, then your score may drop further.

Missed or late payments recorded on your credit report will remain there for five years. With all of this in mind, ensuring that you make your credit card repayments on time is a way to maintain a healthy credit score, so any late repayment might ideally be avoided.

How do you find out why your credit score dropped?

There are a number of websites that you can use to check your credit score for free, including Canstar. According to the Australian Government’s MoneySmart website, you have a right to get a copy of your credit report for free every three months.

Your credit report will list transactions, including amounts borrowed, spent and repaid, and you may be able to link these transactions with changes in your credit score.

If you are concerned about maintaining your credit score, it may be worthwhile to keep a list of transactions you make and credit and loan you apply for, so you can check this against your credit report.

How can you fix errors in your credit score?

Your credit score is based on information that credit providers such as banks, financial institutions, telecommunications companies and utility providers give to credit reporting agencies, and in some cases, they can make mistakes, which can lead to errors in your credit score.

If you check your credit score and believe a legitimate mistake has been made, potentially one that lowered it, then you should be able to have it corrected. Mr Forbes tells Canstar that if you’re concerned about errors on your credit report, there are a number of ways to go about this.

“The quickest way to have information corrected on your credit report is to speak directly with the credit provider that provided the information,” he says. “You should ask them to investigate and amend your credit report if they have made a mistake.”

If this does not work, Mr Forbes says, you can also approach a credit reporting agency directly and request that they conduct an investigation in order to amend your credit report.

Cover image source: fizkes/Shutterstock.com

This content was reviewed by Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article