Last week, tech giant Apple became the first US publicly-listed company to reach $1 trillion market cap.

We spoke to CEO and Co-founder of Stake, Matt Leibowitz, about this historic milestone and what it means for Australian investors. But, before getting into the details let’s go back to basics.

What is a market cap?

Market capitalisation or market cap, as it is typically known, is the total dollar value of a company’s outstanding shares. So, to calculate the market cap of a company you would take the total number of outstanding shares and multiply it by its current share price.

Market cap is directly linked to a company’s size. And the size of a company is important, as some investors consider it as one of the many characteristics that help to determine investment risk. Generally, a large company is considered to carry less risk but lower returns. Whereas, smaller companies are typically riskier but there is potential for higher returns.

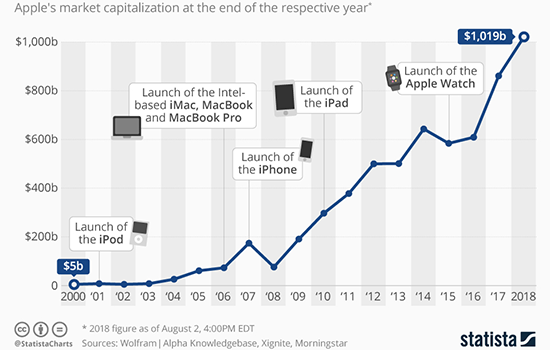

Apple’s road to $1 trillion

If you’re not one of those people who must have the latest Apple gadget, then you probably know someone who is. According to Mr Leibowitz, it’s this brand loyalty that may have been a key factor to Apple’s success and ultimately allowed them to crack the $1 trillion mark.

“Apple has built an amazing brand – a real loyal following. They [Apple] think customer first which has allowed them to generate nearly a cultish kind of following and that’s a really good base to build your business off,” Mr Leibowitz said.

How significant is this new milestone?

Apple is indeed the first US company to reach the $1 trillion mark. However, not the first company in the world to achieve this size market cap – Petro China cracked this milestone in 2007. Although, Mr Leibowitz said that getting to the $1 trillion mark is still a significant achievement, but one that Apple may not take too much notice of it.

“It’s amazing to be the first [US company] to get there. It just identifies Apple as a leader. Although, it’s really just a number and I don’t think that Apple will look at it too closely.” he said.

In the lead up to the company’s recent milestone, the race was on between Apple and Amazon to reach the $1 trillion mark first. Mr Leibowitz said that this reaffirms that the global players are trading on the US stock exchange.

“This is just an indication that the world’s biggest companies are listed in the US. It’s not even that – the next Apple is listed in America, it’s not listed in Australia,” he said.

Is it time Aussie investors took notice?

Last year, an investor study conducted by the ASX found that only 11% of Australian shareholders own international shares. The reluctance of Australians to invest overseas may mean investors are missing out on the opportunity to access global brands available in foreign markets, particularly in the US.

“Australian companies on the ASX are pretty much locally domicile, so it really just indicates to Australian investors that they should be looking elsewhere as well – as part of their portfolio. For some reason they [Australian Investors] have had too much of a local bias,” Mr Leibowitz said.

For those who are interested in diversifying their portfolio and investing overseas, it has never been easier according to Mr. Leibowitz.

“There are platforms and opportunities at present which allow Australian investors to have access to international companies, like Apple, more simply than ever before,” he said.

Share this article