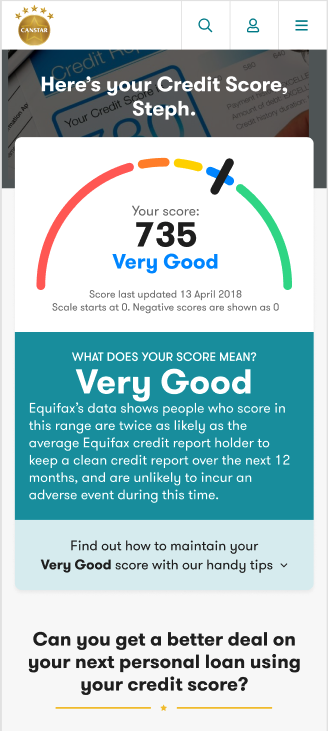

The bottom line is your credit score may affect your ability to get a home loan in a number of ways.

If you’re currently in the market for a home loan, you may have concerns about how a lender will view your application. Your income, occupation and age are all factors that could potentially affect your ability to secure a home loan. However, your credit score can also be an important factor your lender may take into consideration when evaluating your loan application.

For this reason it may be a good idea to refresh your knowledge of what your current credit score is, and think about whether you could be doing more to maintain and/or improve it.

How does a lender figure out my credit score?

Lenders generally check your credit history using information provided by credit reporting agencies. These companies gather data on individuals and use that information to calculate their credit score. This score is based on several factors, including the amount and types credit you have accessed previously, who you accessed it from, and how consistent you were at paying it back. Different credit score providers use different algorithms to calculate your score, so your score may vary depending on who has provided it.

I have a poor credit score – can I get a home loan?

If your credit score isn’t as high as you’d like it to be, it doesn’t necessarily mean that you can’t get a home loan. However, it may be more difficult to get approved as you would likely have to rely on other aspects of your application. You might also only be eligible for certain home loans from particular lenders.

In addition to your credit score, lenders typically take into account a range of factors when assessing home loan applications, including.

- The size of your home loan deposit – generally, the higher it is the less risk for the lender

- Your current financial situation

- Current income

- Savings

- Spending habits

- Your borrowing history (your credit score may be used to give an indication of this)

- The number of status and history

- Assets you own, such as other property or shares

- Whether you are applying by yourself or with a partner

If you are uncertain as to whether you will be approved for a home loan based on your credit score, it may be worth spending some time working to improve your score so you are in a better position overall. Speaking with a financial advisor or financial counsellor may also help you to understand whether applying for a home loan is a good idea for your circumstances.

It’s important to bear in mind that if you apply for a home loan and are declined, the application will typically still be recorded on your credit record. Having a large number of applications on your credit record can be a red flag for lenders.

Could deferring my home loan or missing a repayment affect my credit score?

Many banks have introduced mortgage payment relief in the form of loan pauses or temporary deferrals in response to the economic fallout of the new coronavirus – COVID-19. The Australian Banking Association (ABA) announced on 6 April, 2020 that bank customers who had been granted a six-month deferral on loan repayments on their mortgage, or other credit products, would not have their credit rating affected as a result, provided they were up to date with repayments prior to the COVID-19 pandemic.

Under normal circumstances, a missed loan repayment may be recorded in a customer’s credit report as part of the 24-month record of repayment history information, according to CreditSmart.

The new rules mean that for those customers who are already behind in repayments when they are granted a deferral due to COVID-19, banks would not report the repayment history information, and leave the field blank for the duration of the deferral period. When the COVID-19 repayment deferral period ends, banks would determine how to report the repayment history information, according to the ABA.

How can I improve my credit score?

Improving your credit score is not something you can do overnight – but what you may be able to do in a short period of time is assess your current financial situation, and put together a plan to help guide you towards a better credit score.

This plan could include:

- Figuring out your regular expenses;

- Putting together a disciplined payment schedule for any current debts;

- Building a budget that allows you to save a regular amount every fortnight/month while still making any debt repayments necessary;

- Setting a reminder for paying bills;

- Consider consolidating your debt, if that is beneficial for your personal situation;

- Putting the brakes on any further discretionary spending.

Changing your credit score for the better can be a challenge, but the sooner you start, the sooner your credit score might start creeping up.

This content was reviewed by Deputy Editor (former) Sean Callery and Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article