What Retirees Need To Know In 2017

Retired, or looking forward to retiring soon? Here’s what retirees need to know about account-based pensions in 2017, based on Canstar’s expert ratings and analysis.

As part of our 2017 expert star ratings of account-based pensions, Canstar has analysed the current market for retirees.

In this article, we look at the current fees, the $1.6 million cap on account-based pensions, and your options when it comes to what to do with your retirement savings if you want to access an income from superannuation in 2017.

The latest ABS data shows Australia’s aged population has increased by around 20% from 2010 to 2015 (ABS, 2016). There were 2.2 million people aged 65 years and over living in Australia’s capital cities in 2015, and another 1.4 million living in areas outside our capitals.

For the growing number of people who are at or approaching retirement, it is vitally important to decide what to do with your super and whether or not to open an account-based pension.

Thankfully, we can help you understand the option of having an account-based pension by helping you compare the products currently available on the market.

Compare Account-Based Pensions

Here’s what’s happening in the account-based pensions market in 2017.

Fees on account-based pensions in 2017

There’s a significant difference between the highest and lowest fees charged on a certain account balance across the products that have been assessed this year.

As the table below shows, the cost for the products awarded a 5-star rating is markedly lower than the average cost for products with either a 1- or 2-star rating, and compared to the overall market.

Average annual cost for 1- and 2 star-rated products vs the market vs 5-star rated products

| $100,000 balance | $400,000 balance | $700,000 balance | |

|---|---|---|---|

| Average annual cost for 5-star rated products |

$689/year | $2,471/year | $4,157/year |

| Average annual cost for the market (i.e. all rated products) | $1,061/year | $3,865/year | $6,479/year |

| Average annual cost for 1- and 2-star rated products |

$1,639/year | $6,232/year | $10,204/year |

| Source: Canstar Account-Based Pension Star Ratings 2017.

Average annual cost is calculated for $100k, $400k, and $700k balance for 5-star rated products, for 1- and 2-star rated products combined, and for the market, where the market is all 64 products included in the Account-Based Pension Star Ratings 2017. Average annual cost includes any administration fees and/or member fees, and investment costs including investment management fee, performance fee, and other indirect management costs relating to the investment option selected for comparison purposes. |

|||

Considering other account based pension options? Check out our comparison table below, displaying a snapshot of the current 5-Star Rated market offerings for account-based pensions. Please note that this table has been formulated on the basis of a balanced investment less than $250,000 and is sorted by minimum investment amount (lowest to highest).

Compare Account-Based Pensions

$1.6 million cap on account-based pensions explained

The 2016-17 Federal Budget introduced several changes to how retirement funds are dealt with. This included placing a new $1.6 million cap on the amount of money that can be kept tax-free in an account-based pension.

For amounts up to $1.6 million for people in the pension phase, earnings from the account-based pension income stream will be tax-free.

The $1.6m cap applies per person, so a couple could in theory have $3.2m in the pension phase and pay no tax on the earnings.

What to do if you have more than the $1.6 million cap

Basically, if you have more in your account-based pension than the current $1.6 million cap, you have a few options:

| Pay more tax on the excess | The penalty if you have more than $1.6m in the pension phase is a tax of 15% on the earnings of the excess amount. From 1 July 2018, the grace period is over and the tax will be 30%. |

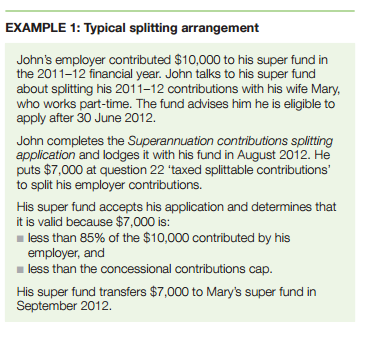

| Split the contributions with your spouse | One strategy for a couple with one person approaching the $1.6m cap is to split their contributions with their spouse to keep their balance under the $1.6m.

However, splitting can only be done on contributions you make in the previous financial year. So for example, if you have $2m in super, you can’t just put $1m in your partner’s name this year to avoid the cap. When splitting, you must transfer no more than 85% of your super contributions to another person, up to the concessional contributions cap. Also beware that if the spouse receiving the contributions is younger the funds cannot be accessed, even as a pension, until they meet a condition of release. |

| Keep it in your super and don’t use it | It may be possible to transfer the excess amount over the $1.6m cap back into the accumulation phase (super), where your earnings are only taxed at 15%. As you are not making any contributions from outside the superannuation system, you do not have to be working or under a certain age in order to do this. |

| Withdraw the excess as a lump sum | You may be able to withdraw a lump sum from your account-based pension to avoid having a balance over the cap.

Keep in mind that withdrawing from your account-based pension can affect your eligibility for the Centrelink Age Pension. Before making any changes, it can pay to contact a Financial Information Services Officer at Centrelink who can talk to you at no charge about your personal situation and possible Centrelink entitlements. |

| Source: ATO information analysed by Canstar Research team. | |

Here’s an example from the ATO of how splitting contributions with a spouse may work in practice:

Source: ATO

Keep in mind that there are additional rules about how you can use your account-based pension. You can contact a qualified financial planner for advice if you aren’t sure what to do.

Compare Account-Based Pensions

How to set up an account-based pension

First, you need to choose an account-based pension fund provider, which is relatively easy because most superannuation account providers also offer an account-based pension. If you’re looking for an account-based pension, consider the top 5-star rated pensions listed in our latest star ratings.

Then you will need to choose the mix of investments that you want to include in your pension. We’ve got more information about how account-based pensions work on our website.

Canstar compares account-based pensions based on a number of factors including available investment options, income payment options, and the cost to invest. Compare account-based pensions using our website and filter your search to find a 5-star rated pension:

Compare Account-Based Pensions

Read our detailed Account-Based Pension Star Ratings methodology to understand why a pension might win a 5-star rating for a particular consumer profile.

Discover more trends retirees need to know about when it comes to account-based pensions in 2017, with our latest star ratings report: