The Financial Planning Association’s (FPA) national research findings released earlier this week revealed that for 37% of people, drawing up short on their savings has been their most significant regret in life.

The research results also found disturbingly high levels of financial stress among Australians.

Not only do Australians regret not saving enough, but the findings also show that 21% of people believe poor financial planning is one of their biggest financial regrets.

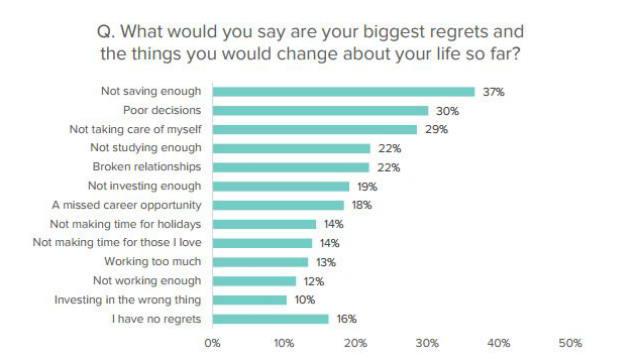

The main regrets for Aussies other than poor saving habits were found to be poor decisions (30%) and not taking care of themselves (29%), while not studying enough and having broken relationships tied at 22%.

The survey seems to highlight some interest in investing, with 19% of respondents saying they regret not investing more and 10% regretting making the wrong investment decisions.

These were the full results:

Source: FPA’s ‘Live The Dream’ Report. Based on a quantitative survey in June 2017 of 2,635 Australians aged between 23 and 71.

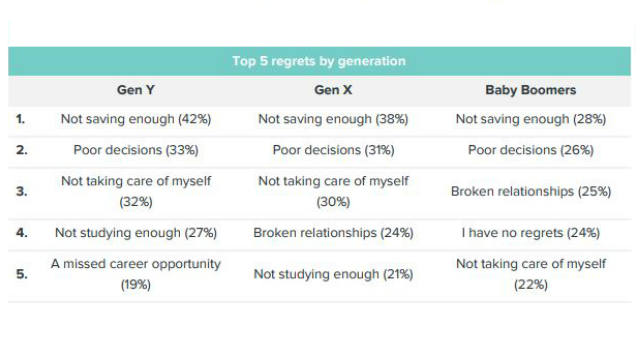

In terms of generational differences, younger Australians are the ones most concerned about how much money they have saved, with 42% of Gen Y respondents and 38% of Gen X saying their regret how little they have put away in the bank.

This compares to only 28% of Baby Boomers, even though not saving enough money is still the number one regret for this older generation.

Source: FPA’s ‘Live The Dream’ Report. Based on a quantitative survey in June 2017 of 2,635 Australians aged between 23 and 71.

Aussies struggle to plan ahead, particularly in NSW

While people struggle with saving and financial stress, the FPA’s findings found that almost three quarters (73%) of Australians find it hard to plan their life and 23% know they will not stick to a plan.

According to the FPA’s report, these are the three hardest parts of planning for Australians:

- Not knowing what they want – 36%

- Finding the right resources to help create a plan – 32%

- Finding the time to map out a plan – 29%

NSW residents, in particular, were found to have the most difficulty with life planning compared to anywhere else in Australia, with nearly half (49%) of the State’s population struggling to plan ahead.

The same residents are also the most stressed about their finances, with 34% saying they are “extremely or very stressed”.

Financial stress is becoming a fact of life, with more and more Australian's struggling to make ends meet. #9Today https://t.co/Doojxclx05

— The Today Show (@TheTodayShow) October 20, 2016

Are you satisfied with your savings account?

Are you satisfied with the rate of interest you are earning? Are you paying fees to save? We want to hear from you!

Have your say in our 30 second survey below.

Share this article