We Love Our (Customer-Owned) Banks

By Justine Davies

Canstar analyses the products and service of 59 Customer-Owned Banking Institutions and announces Bank Australia as the Canstar Customer Owned Bank of the Year.

Australians like to complain about their financial institutions but the statistics don’t back up the rhetoric, and this is especially true when it comes to customer-owned institutions. A recent Canstar Blue survey of 1,898 customers of challenger and customer-owned banking institutions found that an impressive 83 percent of customers are highly satisfied with their institution of choice and only 2 percent of respondents were dissatisfied.

“While the Big 4 banks do dominate the Australian marketplace in terms of market share, Australians actually are spoilt for choice when it comes to selecting a banking partner. We do seem to be becoming more aware of this, with the Customer Owned Banking Association calculating that as a group, credit unions, mutual banks and building societies have approximately 10.1 percent market share now and approximately four million customers across Australia,” said Canstar Group Manager, Research, Mitchell Watson.

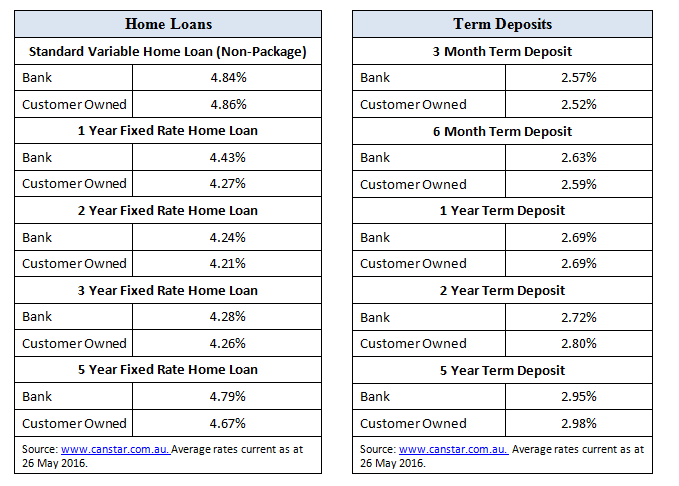

“It isn’t just the personalised service that members of customer-owned institutions appreciate either; the interest rates across both loans and deposits can be very competitive.”

Canstar analysis of 59 customer-owned institutions found that, on average, customer-owned members are getting a good deal. Bank rates listed below are based on all banks listed on Canstar’s database (excluding mutual banks) available for the products noted. Customer Owned Institution rates listed are based on all mutual banks, building societies, and credit unions in Canstar’s database available for the products noted.

| Credit Cards | |||

|---|---|---|---|

| Standard Credit Cards | Interest Rate | Ongoing Fee | Upfront Fee |

| Bank | 17.82% | $52.97 | $52.97 |

| Customer Owned | 12.89% | $35.59 | $3.67 |

Source: www.canstar.com.au Average rates current as at 26 May 2016. |

|||

“Larger institutions on average tend to have more competitive bonus saver and online banking rates,” said Mr Watson. “However when it comes to the accounts that are likely to involve large sums of money, such as home loans, customer-owned institutions are out in front, based on average rates.”

Bank Australia is the Canstar Customer Owned Bank of the Year

Canstar put the microscope over 59 customer-owned institutions across Australia, incorporating credit unions, mutual banks and building societies,

to identify which institution offers the best overall value across a range of lending and deposit products. This year, the winning institution is Bank Australia.

“This year, Bank Australia has consistently shown outstanding value for the consumer across all product areas that we consider within our Star Ratings, particularly within Residential Home Loans,” said Mr Watson.

“As well as products within the lending space, they also offer their customers value for money when it comes to savings and transaction accounts.

“Recent rebranding has also seen Bank Australia revamp their online banking platform and mobile banking apps, making it more user-friendly, functional and flexible for all aspect of customers’ day to day online banking.”

Canstar’s customer-owned banking report is an invaluable starting point for savvy savers and borrowers to research their banking options.

For further information:

Justine Davies

Editor in Chief

Ph. (07) 3837 4151 | 0400 127 733

About Canstar

Canstar provides Australia’s interactive online research service in consumer and business finance. Founded in 1992, Canstar Pty Limited is Australia’s researcher of retail finance information

for over 250 institutions such as Banks, Building Societies, Credit Unions, Finance Companies, Brokers, Mortgage Originators, Life Companies and finance related Internet Portals. Canstar customers use the extensive database for competitor analysis as well as a means of disseminating their product range. Canstar also distributes this information to print and electronic media for publication and to Agents, Accountants, Brokers and Internet Portals for use in advising their clients.

What are the Canstar star ratings?

Canstar researches, compares and rates the suite of banking and insurance products listed below. Results are freely available to consumers who use the star ratings as a guide to product excellence. The use of similar star ratings logos also builds consumer recognition of quality products across all categories. Please access the Canstar website at www.canstar.com.au if you would like to view the latest star ratings reports of interest.

| Account based pensions | Managed investments |

| Agribusiness | Margin lending |

| Business banking | Online banking |

| Business life insurance | Online share trading |

| Car insurance | Package banking |

| Credit cards | Personal loans |

| Deposit accounts | Reward programs |

| Direct life insurance | Superannuation |

| First home buyer | Term deposits |

| Health insurance | Travel insurance |

| Home & Contents | Travel money card |

| Home loans | Youth banking |

| Life insurance |

COMPLIANCE DISCLOSURE and LIABILITY DISCLAIMER

To the extent that the information in this report constitutes general advice, this advice has been prepared by Canstar Research Pty Ltd A.C.N. 114 422 909 AFSL and ACL 437917 (“Canstar”). The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs. Before you decide whether or not to acquire a particular financial product you should assess whether it is appropriate for you in the light of your own personal circumstances, having regard to your own objectives, financial situation and needs. You may wish to obtain financial advice from a suitably qualified adviser before making any decision to acquire a financial product. Canstar provides information about credit products. It is not a credit provider and in giving you information it is not making any suggestion or recommendation to you about a particular credit product. Please refer to Canstar’s FSG for more information.

The information in this report must not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any purpose, in whole or in part, in any form or manner or by means whatsoever, by any person without Canstar’s prior written consent. All information obtained by Canstar from external sources is believed to be accurate and reliable. Under no circumstances shall Canstar have any liability to any person or entity due to error (negligence or otherwise) or other circumstances or contingency within or outside the control of Canstar or any of its directors, officers, employees or agents in connection with the procurement, collection, compilation, analysis, interpretation, communication, publication, or delivery of any such information. Copyright 2014 Canstar Research Pty Ltd A.C.N. 114 422 909. The word “Canstar”, the gold star in a circle logo (with or without surmounting stars), are trademarks or registered trademarks of Canstar Pty Ltd. Reference to third party products, services or other information by trade name, trademark or otherwise does not constitute or imply endorsement, sponsorship or recommendation of Canstar by the respective trademark owner.