A common piece of advice given to consumers is to ‘shop around’, but is going all the way and applying for a loan with multiple lenders a good idea or will it damage your credit score?

Canstar explains the potential impact of making multiple credit applications in a short time frame and what steps you may be able to take to give your loan application its best chance of success the first time around.

Should I apply to multiple lenders?

Applying for a loan or credit card with multiple lenders at one time can be a risky approach to take, as it could affect how you are viewed as a borrower in the future. This is because when you apply for a loan, it is generally recorded on your credit report, regardless of whether you are approved or not. If you make a number of loan applications within a short period of time, other lenders you apply to in the future could see this on your report when assessing your application and view it as evidence that you have been rejected for those previous loans and are therefore a risky borrowing prospect.

A safer approach may be to research a number of products, weigh them up based on their price, features, eligibility and other criteria, and apply for only the one which best matches your needs.

Will multiple loan applications affect my credit rating?

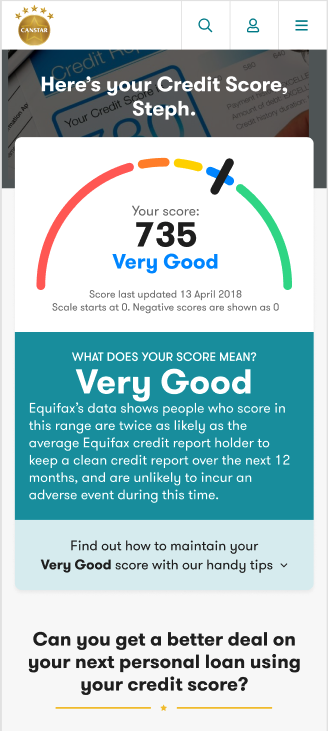

Making multiple loan applications in a short space of time may negatively impact your credit score, as it is typically one of the factors that credit reporting bodies take into account when calculating your rating. According to Equifax, making a number of applications at once flags you as a greater risk than borrowers who make infrequent applications.

How can I maximise my chances of being approved?

To help reduce the chances of your loan application being rejected – and there being a potential impact on your credit report – Moneysmart offers the following tips:

- Check your credit report: Doing this in advance can help you to understand how lenders may view you as a potential borrower. It can be particularly important to look out for any errors on your report and to ask the reporting body to fix them if necessary.

- Pay down your debts: Before applying for a new loan, it may help to reduce your existing debts.

- Consolidate your debt: If you have multiple debts such as personal loans and credit cards, consolidating them into one loan or credit card may help make the debt more manageable, particularly if you can secure a low interest rate and pay off the debts as quickly as you can, ideally within the balance transfer period in the case of a credit card.

- Create a budget: Lenders typically ask to see your recent bank statements when assessing a loan application. Creating a budget and ensuring that your income is greater than your expenditure each month or fortnight could help demonstrate to lenders that you will be capable of affording the credit repayments if the loan is approved.

Main image source: jannoon028 (Shutterstock)

This article was reviewed by our Sub Editor Tom Letts before it was updated, as part of our fact checking process.

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance and home loans with Canstar. You can also check your credit score for free.

Share this article