New credit reporting rules kicking in from 1 July 2022 will affect people entering financial hardship arrangements. We take a look at what is changing.

There have been some big changes to credit reporting in Australia over the years. The biggest was probably the introduction of comprehensive credit reporting (CCR) which allowed positive credit information to be included in credit reports.

Before the move to CCR, a credit report mainly consisted of “negative” information such as bankruptcy or defaults. Now it includes “positive” data including whether you have made your repayments on time over the past 24 months.

A more recent change let Aussies access their credit report free of charge every three months – it was previously every 12 months.

The newest change – set to kick in from 1 July – is how financial hardship arrangements are treated on credit reports.

What is a financial hardship arrangement?

Before getting into the nitty-gritty of the new rules, let’s look at what constitutes a Financial Hardship Arrangement (FHA). Essentially, it’s when a borrower and lender come to some sort of formal agreement to adjust loan repayments because the borrower is experiencing financial difficulty. This might be because they’ve been sick, lost their job or as a result of a relationship breakdown.

Some examples of FHAs may include the lender agreeing to postpone the repayments temporarily, reducing them for a certain period or not charging interest for several months. They may even reduce the repayments permanently and extend the term of your loan.

If you are experiencing financial difficulty, it can be a good idea to chat with your lender. Together you may be able to come up with an arrangement that will work best for you. Keep in mind it should be one you can actually afford.

What will happen from 1 July?

“From 1 July, when you enter into a financial hardship arrangement with a lender it will be reported on your credit report alongside your repayment history for that month,” explained Geri Cremin, General Manager – Strategy and Growth of the Australian Retail Credit Association (ARCA). This will only apply to FHAs entered after 1 July.

Currently, a FHA doesn’t appear on your report. Instead, the lender might leave your repayment history blank or your credit report might show missed repayments – even though these were agreed to with the lender. “The new approach to hardship provides a more accurate picture of a consumer’s credit situation,” a spokesperson from Equifax told Canstar.

Just how it will appear on your credit report may vary depending on the type of arrangement and the credit reporting body the report is from. (The three main credit reporting bodies in Australia are Equifax, Experian and Illion.)

There are generally two types of arrangements – a temporary hardship arrangement or a permanent one that involves a variation to your contract. “These will be reflected differently in your report,” Ms Cremin told Canstar.

Equifax, for example, will place a letter A flag to signal a temporary relief/deferral FHA is in place, according to a spokesperson for the credit reporting body. This will apply when your payment obligations are temporarily reduced or deferred.

When a variation has been made to the terms or conditions as a result of an FHA Equifax will use a letter V to reflect this, explained the Equifax spokesperson.

It’s also worth noting that a temporary FHA indicator will appear each month that arrangement is in place while a permanent variation indicator will only appear on the first month the change takes place.

The repayment history information will then be based on you being able to make repayments based on the terms of the FHA and not at the original level.

This will be pretty much all that credit providers will be able to see on your report about the FHA. “It won’t include details of what the arrangement is or the reason you are in hardship,” pointed out Ms Cremin.

This little indicator will only appear on your report for 12 months – even though your repayment history stays on there for 24 months.

How can this information be used?

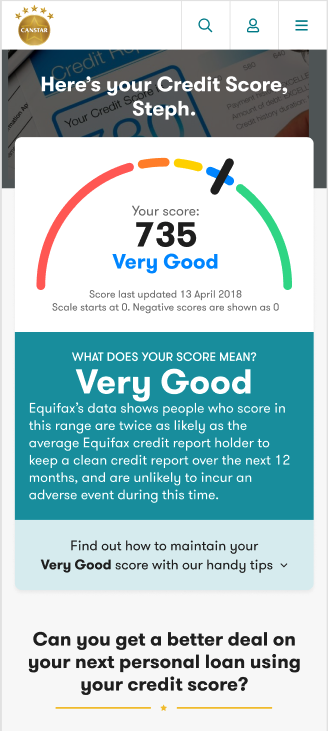

“The hardship information is not allowed to be included as part of your credit score,” explained Ms Cremin. This can be good as it may make your credit score look better she said but had this caveat. “Even though credit score is a really handy indicator of your credit health, lenders will be looking at a range of other factors such as what’s in your credit report and not just your credit score.”

The other good news is that it can’t affect any existing continuing credit arrangements. “A lender can’t use it as the sole basis for closing a credit card or reducing your credit limit,” said Financial Rights Legal Centre’s Senior Policy and Communications Officer, Julia Davis.

Ms Cremin and Ms Davis both pointed out that only credit providers will be able to see this information on your credit report. “Telco and utility providers, for example, can’t report on your repayment history or see financial hardship information,” Ms Cremin told Canstar.

What are the advantages of this approach?

The best bit for the borrower is that it protects their credit report, said Ms Davis. That’s because once you are in a FHA the repayment history will be based on the new arrangement. So, let’s say your repayments are normally $1,000 a month but under the FHA you only have to pay $500 a month – as long as you meet the new repayment amount your credit report will show that you are meeting your repayments and will continue adding to your positive history, explained Ms Davis.

What are the disadvantages?

One of the disadvantages is the unknown. “Because it’s new, we don’t really know how lenders will use the information and if they will use it fairly,” said Ms Davis, adding that the Financial Rights Legal Centre will be monitoring this and regulators such as ASIC and the Office of the Australian Information Commissioner (OAIC) will do their part too.

Will this make it harder to get a loan?

According to Ms Cremin a lender is likely to ask more questions but it won’t automatically preclude you from getting a loan. “Lenders want to make an informed decision,” she explained.

A spokesperson for Equifax shares a similar view. “It is up to each lender to make decisions about extending credit. A consumer may need to supply additional information about their current circumstances to show they can afford a new loan. Making repayments on time each month is one way consumers can demonstrate recovery from hardship,” said the spokesperson.

“Consumers who can’t afford repayments on a credit account they already have should question whether they should apply for additional credit. However, replacing high-cost credit facilities with a credit account that lowers their repayments may put them in a more sustainable position to make repayments and improve their future financial situation.”

What else do you need to know?

The idea of having it flagged on your credit report might make you hesitant to talk to your lender about setting up a FHA but, according to Ms Davis, it shouldn’t. “We can safely assume that having an indicator on your report for 12 months will be better than an extended period of missed payments which will stay on your credit report for two years,” she said. Ms Davis added that it might be a different story if you knew you were only going to miss one or two payments. “There’s still some uncertainty and we will have a better understanding three or four years from now,” she said.

Ms Davis pointed out that if you’re struggling to make repayments and it’s affecting your mental health then entering a FHA could be better for your life than worrying about a flag on your credit report.

And you shouldn’t feel bad or ashamed about asking for help Ms Davis said, adding that FHAs are quite common.

Ms Cremin agreed saying: “Financial hardship can affect anyone. It’s not necessarily a sign of poor credit management. From a lender’s perspective coming to an arrangement can be a positive sign that you are engaging. It’s about getting you the breathing space that you need.”

If you are entering a temporary FHA, Ms Davis said it’s important to understand what happens when that comes to an end and how you will catch up on any missed repayments as you will still owe that money. For example, if your lender agreed to reduce your monthly repayments from $1,000 to $500 for six months how will you catch up on that $3,000? Will the loan term be extended or will you have to make higher repayments after that six-month period ends?

“Make sure you ask the lender how it will be added to your credit report and how any missed payments that you need to catch up on will be treated,” suggested Ms Davis. “Some lenders will treat it as a new arrangement and it may be flagged as such on your credit report.”

She also recommended getting a copy of your credit report a few months later to check for yourself. “If you don’t think it reflects what you agreed to, you have every right to dispute it,” said Ms Davis. You can contact the lender first and if you are not satisfied with the response you can go to the Australian Financial Complaints Authority.

Cover image source: Prostock-studio/Shutterstock.com

This content was reviewed by Editor-at-Large Effie Zahos as part of our fact-checking process.

Share this article