Canstar app

Features our users love

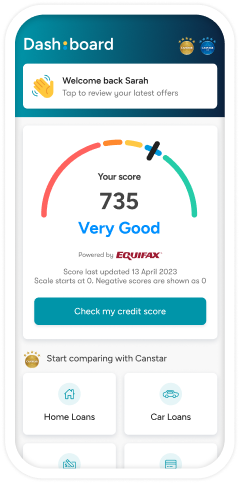

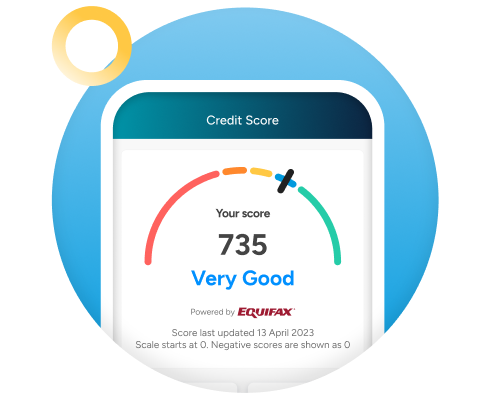

Track your credit score

Now you will be able to check your credit score on the go. What’s more, you’ll be able to see what’s impacting your score as well as tips to help you improve.

Compare products

Compare products from 17 different finance and household expense categories and see if you could be getting a better deal on things like home loans, car insurance, credit cards and much more.

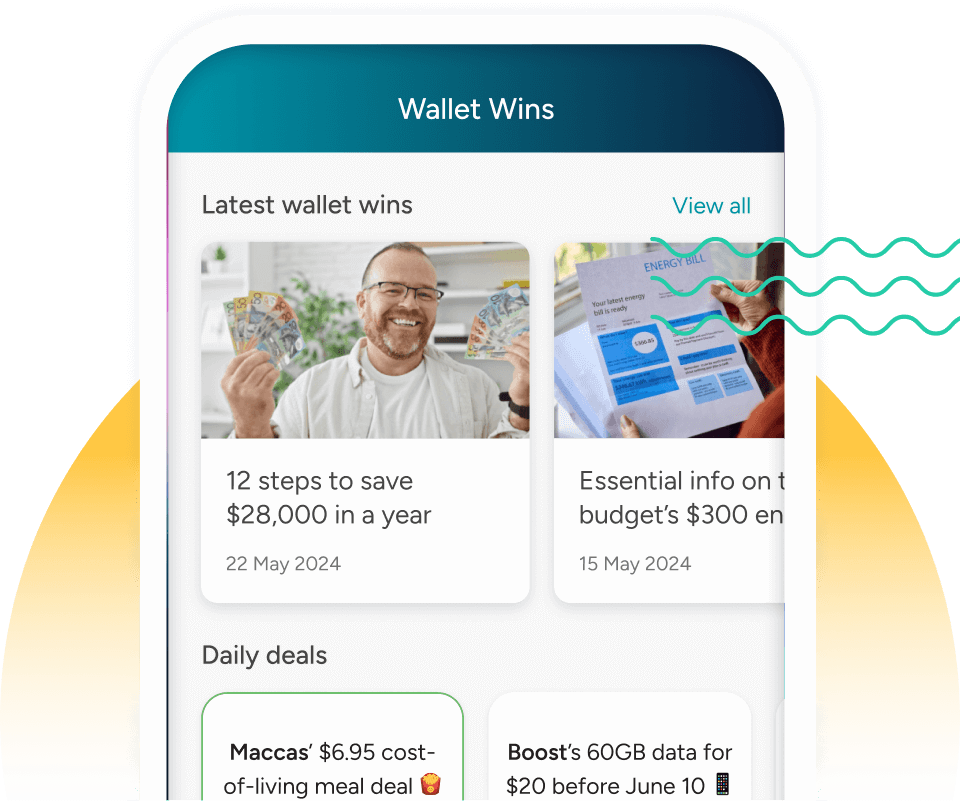

Win at money

Receive tips and offers to help you save and improve your product knowledge and financial literacy skills

Perk up and save

Get access to a wide range of App-only offers, promotions and giveaways on anything from tech, appliances and subscriptions.

Frequently Asked Questions

What our App users are saying

Leonie. K

Have been relying on Canstar for years initially to research bank loan rates and this helped me talk confidently either to new lenders or to negotiate better rates with existing lenders.

Cathy. W

Love this tool – super easy to use, and great to get an instant snapshot of your credit rating.