With more than $3 trillion of superannuation assets held in Australia you want to be sure your slice of the funds, if you have super, is doing okay. One of the ways to do that is to regularly check your superannuation statement.

Depending on where you are on your super journey, there’s often a tendency to ignore or pay little attention to your super statement that you receive from your fund.

Steve Travis, Group Executive Member Growth at Aware Super, told Canstar you should treat your super statement as a vital health check on how your super is performing and growing.

“It’s something that, if you give it time and attention now, will reward you in later years,” he said. “Your future self will thank you for spending time on it now.”

It can be useful to know what your super balance is at the moment and how that is invested and growing, and all of this and more information can be found on a super statement. So here’s a guide on what to look out for on your super statement, and what information your super provider needs to know about you.

1. Check your personal details are up-to-date

It’s important your super provider has all your correct personal details on the statement – name, address, date of birth etc. – otherwise you could encounter some major issues.

For example, if you’ve recently moved, changed your name, email address or any of your other details, contact your fund and let them know about the changes as soon as possible.

You may be able to do this online, or contact your provider by phone, email or post if you’d prefer. Check with your fund to see if you need to provide any supporting documentation.

2. Check your fund has your tax file number recorded

Your super fund needs your tax file number (TFN), otherwise the Australian Taxation Office (ATO) says you might end up paying a much higher tax rate on your superannuation earnings, your employer contributions will be taxed at a higher rate, and you’ll be unable to make after-tax contributions to your super.

3. Check your super contributions are regular and on time

If you’re an employee, your payslip should say what amount is paid into your super each pay day or quarter, but it’s important to check your super statement to make sure those payments do actually make their way to your super fund.

If the payments don’t show there could be a communication or technical issue between your employer and super provider that needs fixing. You should then contact them to check your details are up-to-date and so on. You won’t know if something is wrong if you don’t check your super statement.

The ATO says your employer must pay your superannuation guarantee (SG) contributions into your super fund at least four times per year, by the quarterly due dates.

4. Check your balance and how your money is invested

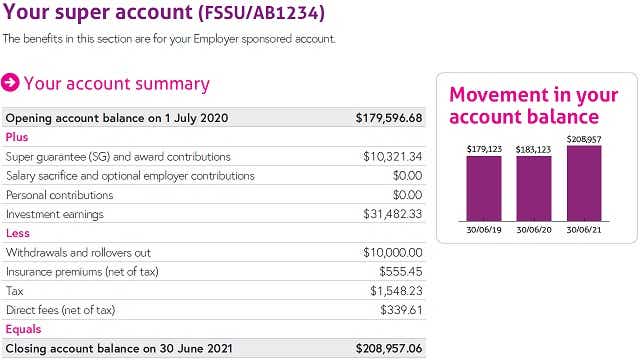

Your statement should include a snapshot or summary of how your super balance has changed (hopefully grown) since your previous statement, plus any fees or taxes you may have incurred.

Your super money can be invested in a wide range of asset classes – anything from cash to infrastructure to Australian shares to property. The investment options available to you, and how they’ve performed over a period to time, should be listed on your statement.

The mix of your investment options may change depending on your risk profile that you should set up with your super provider.

If you have not chosen any investment options for your money, it will generally be in a default mix of growth and conservative assets, which may change over time as you age and near retirement age. If you wish to change your investment options you’ll need to contact your provider.

You can find out more about what investment options may be available to you at ASIC’s Moneysmart website, or check with your super provider.

5. Check you’re not paying too much in fees

Most superannuation products come with a range of different fees that are charged to you. Some fees you may see as reasonable when considered against the features and investment options offered by a particular provider, but some fees you may consider to be excessive.

Check your super statement or contact your fund to see what fees you’re paying and see whether or not you’re happy to keep paying them.

Canstar’s superannuation comparison tables show the estimated annual cost of each fund (including any membership and administration fees) for members in the default investment option at certain levels of investment.

Compare superannuation funds

If you’re comparing superannuation funds, the comparison table below displays some of the products currently available on Canstar’s database for Australians aged 30-39 with a balance of up to $55,000, sorted by Star Rating (highest to lowest), followed by company name (alphabetical), and with links’ to providers website. To learn more about performance information, click here. Consider the Target Market Determination (TMD) before making a purchase decision. Contact the product issuer directly for a copy of the TMD. Use Canstar’s superannuation comparison selector to view a wider range of super funds. Canstar may earn a fee for referrals.

6. Check you’re adequately insured for your needs

Many people are content to make do with any life insurance provided to them through their super fund, but you should check that the level of cover provided for you is adequate in terms of things such as maximum payout, what you’re covered for and for how long you’re covered, and that you’re happy with what you’re paying in premiums from your super account.

There are pros and cons to having life insurance in your super, but if you’re still concerned about your cover then contact your super provider to discuss your options.

7. Check your listed beneficiaries are still correct

Your listed beneficiaries are the people you want to receive the money from your super fund and applicable insurance cover in the case of your death, so it’s important that you’ve named the right people.

For example, if you named your spouse as a beneficiary but you’ve since divorced, you may want to get that changed. Your named beneficiaries may have since died, or maybe you have a new spouse or child that you haven’t previously named as a beneficiary. It’s a good idea to keep track of who you’ve named and make corrections if needed.

Your superannuation trustee is not bound to follow your wishes unless you set up a binding nomination.

Some super providers allow you to set a binding nomination for a set period of time, so you need to check that it is still up to date, or you may be able to set up a non-lapsing binding nomination. Again, it’s important to check you have the correct people nominated.

Mr Travis said this was especially important if you have a complex family history with the potential for several beneficiaries from multiple relationships.

8. Check if you can consolidate multiple super accounts, if appropriate

If you’ve held a number of jobs over the course of your working life it’s possible you have money in other super accounts, away from your main super fund. If you get multiple super statements that means you could be paying multiple fees that will eat into your total pot, or you could have funds with a provider that is underperforming.

You may be able to consolidate multiple accounts into one place. But you need to check that it is possible to consolidate the funds, and that you don’t lose out on any benefits from accounts you are thinking of closing and consolidating. Not all funds allow you to consolidate them into another fund so it’s important you keep an eye on their fees and performance.

Recent changes mean many workers will now have a ‘stapled’ super fund that follows them if they don’t choose a new fund when they change jobs, but you may still have more than one account from changing jobs in the past.

If you’re not sure if you have multiple accounts it’s easy to check if you have any lost super, and if you do decide to consolidate multiple accounts in one place that’s relatively easy to do as well.

You should seek financial advice if you are in any doubt about whether to consolidate funds or not.

9. Check you’re happy with your super fund

You may have ticked all of the boxes above, but after checking your super statement you should look at the big picture and think long and hard about whether or not you’re satisfied with your chosen super fund.

“Is your super doing its job, is it working hard enough for you,” Mr Travis said you should ask yourself when checking your super statement.

An important point here is to check to see if your super is underperforming, according to monitoring by the super regulator, the Australian Prudential Regulation Authority (APRA).

You may also want to think about factors such as your insurance and investment options, the customer service you get, and the growth of your super. You might decide after comparing your options that you’re perfectly happy with your super fund, or you may feel it’s time to make a change.

Mr Travis said most super providers had a range of online tools you can use to see how your super is tracking, estimate how much you need to retire and suggest whether you need to contribute more. You can also use Canstar’s superannuation and retirement planning calculators.

Your super statement may appear boring and daunting to read, full of figures and terms that can be tricky to understand, but Mr Travis said most super providers do try to make their statements as interesting as they can so you do read them and pay attention to what’s going on, and make any necessary adjustments.

Mr Travis said you should use your super statement to help answer the following points:

- Are you in the right super fund?

- Is your super fund doing its job?

- How much more do you need to contribute?

“Remember, your super is your money,” he told Canstar.

Cover image source: Justlight/Shutterstock.com

This content was reviewed by Deputy Editor, Canstar Amanda Horswill as part of our fact-checking process.

Share this article