Are you planning on applying for credit or a loan in the near future? If you are, it might be a good idea to check your credit score.

Do you know what your credit score is, or how it’s calculated? This article covers:

What is a credit score?

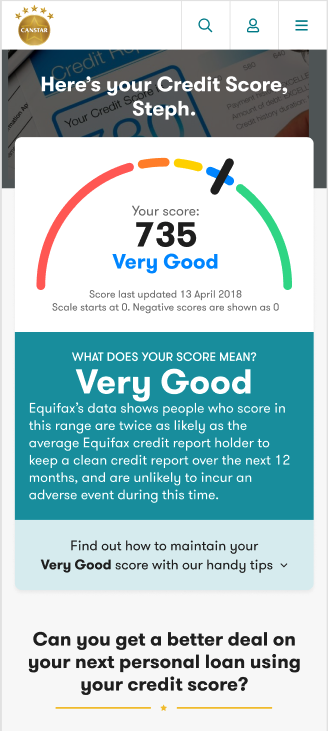

A credit score or credit rating is one factor that lenders use to help determine how trustworthy you are as a prospective borrower. Your credit score is a number that will typically sit on a scale of zero to 1,000 or zero to 1,200, depending on which credit reporting agency you go through. The higher your credit score, the more creditworthy you are usually seen to be – and vice versa.

How is your credit score calculated?

Your credit score is based on the personal and financial information available in your credit report. Each credit reporting body uses a slightly different algorithm to calculate your score and uses varying credit score ranges. Each body may also hold different information about you. As a result, your credit score may vary depending on which credit reporting body has calculated it.

Your credit report is based on information available from lenders (such as banks, credit unions and payday lenders), as well as any public record information (for example, any court judgments) available at the time. It may also include information from telecommunication and utility providers about any defaults or credit advances.

Your credit report typically includes:

- Your personal details, including your name, date of birth, employment history and length of time at your current address

- Details of the credit or loan products you have held in the past, including the credit provider, the type of product, the opening and closing dates of the account and your credit limit

- Details of the applications you’ve made for credit or a loan, including the number of applications, as well as the type and size of the credit or loan you requested

- Your repayment history

- Any overdue accounts

- Information about any court judgments, bankruptcy or personal insolvency

These factors are taken into account when calculating your credit score. For example, if you applied to multiple credit providers in a short space of time, this may signal that you are in credit stress and may negatively impact your credit score.

According to reporting body Equifax, this flags you as a greater risk than someone who has made infrequent applications for credit with only a few credit providers. Similarly, if you have any defaults or court judgments listed on your report, this may also lower your score.

How can you achieve a good credit score?

If your credit score is lower than you would like, the good news is that you can take steps to help improve it. Your credit score is based on the information that is available at the time it is requested, which means it can increase or decrease as new information is added. For example, you may be able to improve your credit score by consistently paying your credit card bills and loan repayments on time. Additionally, negative information, such as overdue accounts and court judgments, will drop off your file after a certain period of time.

To help increase your credit score, you may want to:

- Make sure you pay your credit or loan repayments and bills on time – setting up automatic payments could help with this.

- Limit the number of new applications for credit or loan products you make, if you can.

- Lower the credit limit on any credit cards you have, if you can.

- Regularly check your credit report and make sure that the information in it is correct. If something is incorrect, you can contact the credit reporting body to get it changed.

You can find more tips in our article on ways to help improve your credit score.

Learn more about credit scores

You can also find out more about credit scores through Canstar’s Credit Score Hub:

This article was reviewed by our Sub Editor Jacqueline Belesky and Finance Editor Sean Callery before it was published, as part of our fact-checking process.

Main image source: Fatmawati achmad zaenuri (Shutterstock).

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance and home loans with Canstar.

Share this article