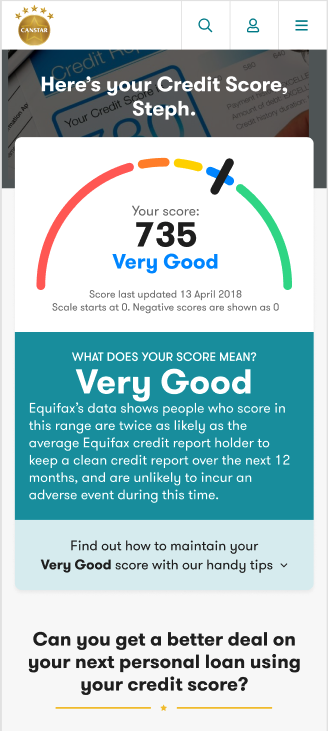

If you’ve got a good credit score and want to keep it that way – or even make it better – here are some steps to think about.

Pay your bills on time

If you’ve already got a ‘good’, ‘very good’, or ‘excellent’ credit score, you’re probably paying your bills in full and on time. Continuing to do so consistently may help you maintain and improve your credit score, and improve your odds of being considered a reliable lending prospect by lenders.

To help you stay on track, it may be a good idea to consider building up a ‘buffer fund’ of savings, to ensure that you can pay your bills in the event of significant unexpected expenses.

Continue to demonstrate that you can manage credit

If you’ve gotten your credit score to at least ‘good’ while making responsible use of a credit card or other line of credit, you may want to consider keeping them open, if this is possible and prudent for you to do. Ongoing, responsible use of a credit facility is generally viewed positively by lenders and credit reporting agencies, as it demonstrates that you can manage your spending and repayments responsibly.

That being said, because of the introduction of Comprehensive Credit Reporting in Australia, closing unnecessary or risky credit accounts can also have a positive impact on your credit score.

It’s worth remembering though, that opening and closing credit accounts too often may potentially have a negative impact on your credit score.

Make progress on paying down your debt

It’s possible to have a ‘good’, ‘very good’, or ‘excellent’ credit score while also having outstanding debt, such as a mortgage, student debt, or a personal loan. Evidence that you’re making steady progress towards repaying your debt is what lenders are likely to be looking for if this is the case.

And while it may not be feasible to get it fully paid off in the near future, demonstrating the ability to make regular, consistent repayments towards your debt will generally be taken as a sign that you’re a responsible borrower and may be a safe lending prospect.

If your existing debt is on a credit card, which typically comes with a higher interest rate than other credit products, it may be worth focusing on repaying that debt first. If that’s not currently feasible, you could consider making use of a credit card with a balance transfer offer to move the debt to a card with a lower or 0% interest rate for a certain time period. However it’s worth noting that this will revert to a higher interest rate after the promotional period ends. You can view some of the 0% balance transfer offers currently available in Canstar’s database here.

Be careful when applying for additional credit

If your credit score is looking good at the moment, you may feel confident applying for additional credit products – say a second credit card or another loan. But it’s worth remembering that each application for credit typically involves what’s called a ‘hard check’ on your credit score by the lender assessing your application.

Hard checks are recorded on your credit history and are taken into consideration when calculating your credit score.

Multiple hard checks in a relatively short period may negatively affect your credit score, as it could be viewed as evidence that you are borrowing too much. So it may be worth carefully considering each additional credit application you make.

Keep an eye on your credit report

Another important aspect of protecting your credit score is checking that there are no inaccuracies on your credit report.

For example, if you fall victim to identity theft or credit card fraud, the financial fallout can have an impact not just on your bank account, but your credit score as well.

It may be a good idea to thoroughly check your credit report on a regular basis. This could help ensure that any fraudulent or incorrect listings on your credit report can be reported and investigated ASAP, potentially preventing them from doing any serious or long-lasting damage to your credit score. If you suspect you’ve been the victim of identity theft, you should tell the credit reporting agency ASAP so that they can amend your file.

If you want to check your credit score, learn how they work, or find out more about improving your score, visit our credit score information hub.

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance, as well as home loans, with Canstar.

This content was reviewed by Editor-in-Chief Nina Rinella as part of our fact-checking process.

Share this article