First Home Buyer Survey 2023

First Home Buyer Survey

July : 2023

First home buyers saving more but still spending 8+ years to build a deposit

A new Canstar survey reveals the top trends among prospective first home buyers hoping to escape the rental treadmill.

Potential first home buyers are managing to save more per month now than they were last year but they are still stressed about their ability to build an adequate deposit and escape the rental treadmill, according to new research from Australia’s biggest financial comparison site*, Canstar.

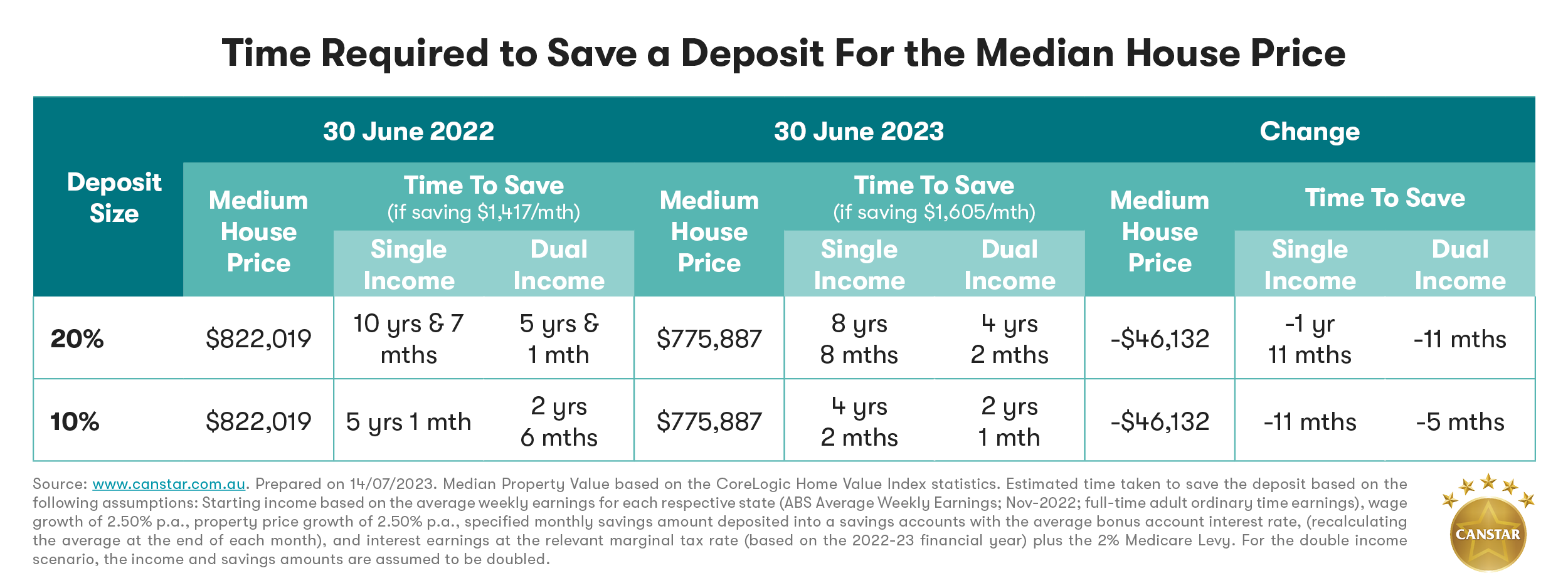

Canstar’s new First Home Buyer Survey of 1,088 potential first-time buyers found they are saving on average $1,605 per month to put towards their home deposit. This is up by $188 per month or 13% compared to last year when those saving for their first home say they were saving $1,417 monthly.

This increase in savings could cut the time to gather a 20% deposit on the median house price by just shy of 2 years for a single income buyer with saving potentially taking 8 years and 8 months. A double income couple each saving $1,605 per month could cut the time to save a 20% deposit by almost 1 year and save for 4 years and 2 months.

The time to save a smaller 10% deposit on the median house price with the increased savings could be cut by 11 months for single income buyers, with it possible to take only 4 years and 2 months to save while couples each saving $1,605 could buy 5 months sooner after saving for just over 2 years.

The time to save a 10% deposit doesn’t account for saving to pay Lenders Mortgage Insurance (LMI), which in some instances may be able to be added to the loan with borrowers generally charged interest on it.

Canstar’s Editor-at-Large and money commentator, Effie Zahos, says, “First home buyers being able to save more in a cost of living crisis shows how determined Aussies are to get off the renting treadmill. Property prices are continuing to rise but rents are also rising to historic highs. Renters are no doubt feeling the pressure to get a foot on the property ladder.”

“Nine in every ten potential first home buyers are prepared to make comprises to buy sooner. Radically reducing their spending was top of the list for what they would comprise on followed by purchasing an older property and buying an apartment over a house rounded out the top three.”

While 62% of potential first-time buyers are regularly saving, worryingly, one-quarter don’t know how much they are regularly saving and 13 percent aren’t in a position to save.

Majority feeling stressed about their ability to save

Saving just over $1,600 per month may not be enough for some with close to one in two (48%) current first home buyers-to-be feeling extremely or very stressed about building a big enough deposit to purchase a home and a further 40% feeling somewhat stressed.

This equates to 89% of first-time buyers anguishing over their ability to save, which was similar to last year when 90% felt stressed about their ability to save.

The majority (61%) of current potential first home buyers say that bills and household expenses are the biggest expenses that are stopping them from being able to save more. This is followed by paying rent (49%) and going and/or eating out (42%) rounding out the top three reasons.

Zahos says stress can be brought on by not allowing yourself wriggle room in the budget.

“In an economic crisis, not everyone is going to be in a position to save more, let alone build up enough for a deposit on a home,” says Zahos.

“Focusing on what you can realistically save and being flexible with your timeline can alleviate the pressure until your financial situation improves and you can boost your savings balance.”

More getting help from the Bank of Mum and Dad

Mum and dad may be helping to ease the stress with a growing number of first home buyers-to-be getting some support from their parents. This year 29% of potential first home buyers say they are receiving some form of contribution from their parents or family, which is up from 21% last year.

This help is coming in a variety of ways with parents most willing to provide rent-free accommodation to their children to help them save (8%), followed by contributing to living costs (7%), a financial contribution to their deposit (7%), going guarantor on the loan (5%) or buying with them (3%).

“The Bank of Mum and Dad may not be closed to first home buyers but parents are certainly preferring to offer assistance in ways that don’t require them to put their hands in their own pockets,” says Zahos.

“It’s far less risky to have your kids live at home rent-free to help them save for a deposit than to just give them a deposit or put your house on the line.

“The Bank of Mum and Dad comes with warnings. After 12 rate hikes those parents that jumped in and helped their children financially one or two years ago may find that they are now being called on to bail the kids out as they struggle with much higher repayments and are trapped in mortgage prison with little equity in their loan to refinance to a lower rate offer.

“Parents deciding to go guarantor on a loan to help their child buy sooner should consider limiting the amount of their guarantee, check that their child has some form of income protection insurance, work out an exit strategy to release the guarantee and get independent advice so both parties know their roles and responsibilities.”

Deciding on realistic property expectations

Rising interest rates are lowering the borrowing capacity for first-time buyers and making repaying a loan more difficult, but the good news is that the majority (51%) intend to spend conservatively, with a purchase price of $600,000 or less in mind. A further 28% are budgeting to spend between $600,001 and $800,000 and only 21% have a budget over $800,000.

First home buyers are encouraged to download Canstar’s free Bright Stars Report that identifies the most affordable and promising locations where buyers can get a foot in the market with less than $60,000 saved.

Great news too is that 70% of first home buyers-to-be are planning on applying for state and/or federal first home buyer grants and schemes to make the most of their borrowing power.

“Buying your first home is a big decision. One that you need to go in with eyes wide open. First-time buyers need to be realistic about what they can afford and stay committed to their budget,” says Zahos.

“Ways to boost the budget be by making the most of any stamp duty concessions or first home buyer grants by stacking them where possible.

“Buyers could also take up the Government’s First Home Guarantee Scheme that allows them to buy with a 5 percent deposit to get into the market sooner and beat potential price rises. A very small deposit means taking out a bigger loan, and this means paying more in monthly repayments than if you had a larger deposit. The good news is buyers have a lot of options to consider.”

In this more challenging environment, it’s all the more important for first home buyers to choose a home loan lender carefully to ensure they’re getting value for money.

Canstar’s new First Home Buyer Award results could be a helpful guide for borrowers. This year Canstar assessed 622 first home buyer loans from more than 42 lenders to determine which bank came out on top nationally and which customer-owned institutions scored highest in different parts of the country when it comes to the products and services they offer to first home buyers.

To compare home loans from over 80 lenders, visit www.canstar.com.au.

For further information:

Belinda Williamson

Group Manager, Corporate Affairs

Ph: 0418 641 637

Belinda.williamson@canstar.com.au

Notes to Editors

* Please refer to: www.canstar.com.au/biggest-original