Do you trust your credit card provider to protect your card from fraud? Do you trust it to act in your best interest?

A recent Canstar survey found Australian consumers, on average, have more faith in their credit card provider’s ability to protect their card from fraud than they do in its willingness to act in their best interests or provide support in times of hardship. Interestingly, younger people had higher-than average levels of faith in the latter.

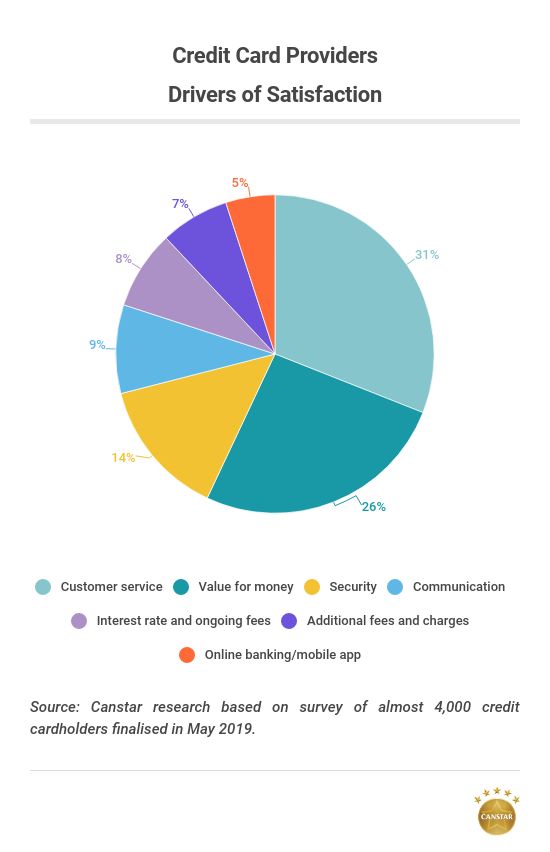

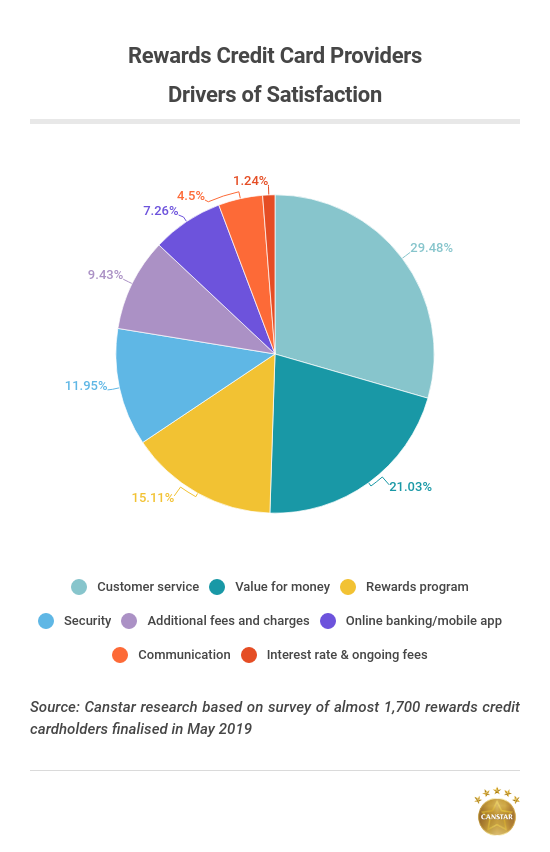

The survey of nearly 4,000 credit cardholders, of whom about 1,700 had a rewards card, also asked respondents to grade their overall satisfaction with their credit card provider, with the results forming the basis of our first Most Satisfied Customers Credit Card Provider and Most Satisfied Customers Rewards Credit Card Provider Awards.

Our Most Satisfied Customers Awards are based on how customers rate their overall satisfaction with a particular financial institution, and complement our Star Ratings and Awards that are calculated by Canstar’s expert researchers.

Canstar’s Group Executive of Financial Services, Steve Mickenbecker said the Customer Satisfaction Awards were like word-of-mouth recommendations from friends.

“People are very good judges of when they have received good service and when their expectations have been met or exceeded,” he said.

Bendigo Bank wins Award for Most Satisfied Customers – Credit Card Provider

Bendigo Bank has won Canstar’s 2019 Most Satisfied Customers Credit Card Provider Award.

Customer service was the biggest indicator of customer satisfaction, based on those surveyed.

This was closely followed by value for money. The below pie chart shows a complete break-down of what had the biggest weighting on survey respondents’ satisfaction with their credit card provider.

Interestingly, customer service was valued over four times more highly than credit card interest rates and fees, or the costs of additional fees and charges.

“The survey has found a small proportion of people consider interest rates and fees in their assessment of satisfaction,” Mr Mickenbecker said.

“Unfortunately, this indicates that some customers are susceptible to paying too high a rate on their balance on the card.”

Canstar’s survey also found that the majority of respondents have been with the same credit card provider for more than 10 years, while 10% of people said they were intending to switch during the next 12 months.

Mr Mickenbecker said it was a concern that some people were not reviewing their credit card provider more regularly, given that rewards earn rates have reduced significantly over the past 12 to 18 months, and purchase rates on Canstar’s database range from below 10% to 24.99% per annum.

American Express wins Award for Most Satisfied Customers – Rewards Credit Card Provider

American Express, the US-based multinational financial services provider, has won Canstar’s 2019 Most Satisfied Customers Rewards Credit Card Provider Award.

Once again, customer service was the most reliable indicator of customer satisfaction, based on the survey data.

This was followed by value for money and rewards program details, while interest rates and ongoing fees were last on the list.

“This may imply that people who are using rewards cards are paying off their credit card in full every month, making the interest rate less relevant to them,” Mr Mickenbecker said.

The below pie chart shows a complete break-down of the main predictors of survey respondents’ satisfaction with their rewards card.

Canstar’s survey also found higher-income people were more likely to have a rewards card, while people on lower incomes were more likely to have a low rate or low fee credit card.

Consumers with rewards and frequent flyer cards were found to have made a significantly bigger purchase, on average, than those with low rate and low fee cards.

The average cost of the largest purchase made with their credit card was $5,831 for those with a rewards card compared to $2,692 for those with a low rate card.

Mr Mickenbecker said rewards credit cards tend not to be that rewarding if your spend level is low.

“People under thirty years and low-income earners are likely to be in the lower-spend group, so it’s logical they would be thinking about low rate and low annual fee cards,” he said.

Share this article