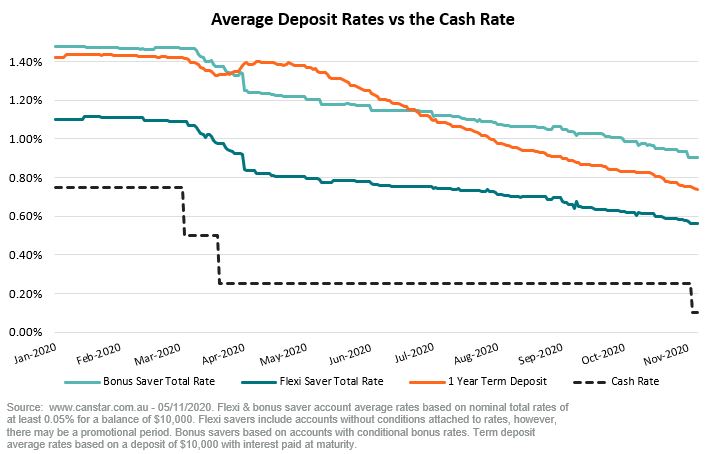

Now that the cash rate has been cut to the historic low of 0.10%, savers may be worried their interest rates could trend down as well.

After all, Canstar data shows home loan rates have already started to fall. And Australians who rely on interest from savings accounts and term deposits have seen their rates trend downwards for most of the year.

If financial institutions pass on the latest cash rate cut to savers, consumer interest rates could fall even lower.

Canstar analysis of interest rates on our database shows if the full November cash rate cut of 0.15 percentage points were passed onto savers, it could see regular savings accounts (including those with introductory bonus rates) fall to an average rate of 0.40%, and bonus savings accounts (where you’re required to meet certain conditions to earn bonus interest) fall to an average rate of 0.74%.

As for term deposits, one-year term rates could fall to an average of 0.58%, three-year terms to 0.62% and five-year terms to 0.61%, according to our database analysis.

But despite a trend of lower rates for savers and the economic pressures of this year leading to an almost unprecedented number of Australians being out of work, Australians are still saving a record amount.

A Canstar survey in September of 1,025 Australian adults* revealed 31% of respondents had added more to their savings during the COVID-19 pandemic than they usually would.

IBISWorld research released in September reflected this, revealing the savings rate in Australia had surged this year due to weak consumer sentiment and social distancing restrictions that undermined household consumption expenditure. The rate reached 7.90% of overall disposable income in 2019-20, compared to just 2.70% the year before, the research found.

The researchers predicted household savings were likely to remain at elevated levels for at least the next three years, during which time the Reserve Bank has indicated it won’t be raising the cash rate.

A saver and owner of a small business, Xara (last name omitted), told Canstar her and her partner’s attitude towards saving money had changed since the pandemic hit.

“We were already on the path to saving, but when COVID-19 hit we became more serious about it,” Xara said.

“I have a small hairdressing business so was eligible for JobKeeper and this has helped in being able to save more.”

Xara said choices around spending money had now become much more intentional, as she uses a personal finance management app to help manage incomings and outgoings.

“We’re spending less on fast food and coffees and putting money away for a nice night out or investing in sports activities for our daughter,” she said.

“There are definitely a few things we’ve had to cut back on – holidays for one, given we can’t travel anywhere. Lunches are also a big area of saving – I’ve been preparing more lunches at home which has helped our savings too.”

Xara said her primary concern was next March when the government subsidies, such as JobKeeper, are due to end.

“My main motivation is saving as much money as possible while I have the support,” she said.

The Reserve Bank Governor Philip Lowe admitted the decision to cut the cash rate involved consideration of the impact of lower interest rates on savers, which could push people into “additional risk taking”.

“Low deposit rates can be very difficult for some people, particularly those relying on interest income, and these issues will need to be closely watched over the coming months,” Dr Lowe said.

While lower rates may entice some consumers to invest their money elsewhere than in a bank account, many savers are clearly eager to stash their cash for a rainy day. This could be partly due to the safety savings account and term deposits can offer, where balances of up to $250,000 with an Authorised Deposit-Taking Institution (ADI) are guaranteed by the Australian Government.

Our research analysts broke down where Aussie savers may be able to find the top interest rates.

Where to find the top interest savings accounts and term deposits on our database

Canstar’s research analysts found that if a consumer chased the highest introductory rate offers on regular savings accounts by switching to the top rates at the end of each introductory offer, they could earn $171 in interest in a year, based on products on our database and assuming introductory offers and rates remained the same throughout that time.

In comparison, the highest bonus savings account rate on the database at the time of writing could earn them $151 a year, or the highest term deposit rate could earn them $155 in a year.

Of course, savers may be considering more than just interest rates when choosing between savings accounts and term deposits. The latter may be a relatively low-maintenance option for people who are happy to leave their money untouched for a certain period, while savings accounts may allow more flexibility to access cash if need be.

Also worth keeping in mind though is the fact that the difference between the highest savings rates on the market and the lowest can be considerable, which is why it pays now, arguably more than ever, for consumers to conscientiously find the best deal for themselves.

With that in mind, we gathered some of the top rates for savers available on our database at the time of writing.

Top savings account rates on Canstar’s database

| Financial Institution | Account | Base Rate | Bonus Rate | Promo Rate | Promo Period | Total Rate |

| Rabobank Australia | High Interest Savings Account | 0.55% | – | 1.45% | 4 months | 2.00% |

| Heritage Bank | Online Saver | 0.80% | – | 0.80% | 4 months | 1.60% |

| Macquarie Bank | Savings Account | 1.35% | – | 0.15% | 4 months | 1.50% |

| MyState Bank | Bonus Saver | 0.15% | 1.35% | – | – | 1.50% |

| ING | Savings Maximiser | 0.10% | 1.40% | – | – | 1.50% |

Source: www.canstar.com.au – 05/11/2020: 11:00am AEDT. Based on a deposit of $10,000. Top 5 selected and table sorted in descending order by total rate, followed by base rate. Total rate includes the base rate plus any conditional or promotional bonus rates. Conditions may apply to bonus and introductory rates, contact the relevant company for full terms and conditions.

Top term deposit rates on Canstar’s database

| Financial Institution | Product | Rate | Term | Payment Frequency |

| Judo Bank | Personal Term Deposit | 1.55% | 3 years | End of term |

| BankVic | Term Deposit (I20) | 1.25% | 9 months | End of term |

| Greater Bank | Term Deposit | 1.15% | 5 years | End of term |

| Teachers Mutual Bank | Term Deposit | 1.10%^ | 1 year | End of term or Monthly |

| MOVE Bank | Fixed Term Deposit | 1.05% | 15 months to 2 years | Annually |

| Heritage Bank | Term Deposit | 1.05% | 2 years | Annually |

Source: www.canstar.com.au – 05/11/2020: 11:00am AEDT. Rates based on personal non-compounding term deposits for a deposit of $10,000. One product per provider is displayed. Table sorted in descending order by rate, followed by ascending order by term. ^Also available from Unibank.

*Survey source: www.canstar.com.au, September 2020. Survey of 1,025 Australians aged 18+. Commissioned by Canstar and conducted online via Qualtrics in September 2020.

This article was reviewed by our Sub Editor Tom Letts before it was published as part of our fact-checking process.

Follow Canstar on Facebook and Twitter for regular financial updates.

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance and home loans with Canstar. You can also check your credit score for free.

Share this article