Josh Callaghan, Canstar’s General Manager of Wealth

There are a multitude of reasons why people don’t invest. I’ve probably heard them all: I don’t have the time or money, it’s too hard, I wouldn’t know where to start… etc. It’s these typical responses to investing that motivated us to start Canstar Investor Hub—because they’re all able to be overcome.

One of the conversations that I seem to have less often is why someone might invest. This one is a little more interesting for me and is a question which can really help investors stay focussed on their goal and ride out the ups and downs of the market more comfortably.

I tend to group investors into two main objectives: goals based and wealth maximisation. The former is all about how much the investor needs and by when, which then leads to a plan around contributions, required return and so on. Wealth maximisation is not so much about achieving a particular outcome, but rather just putting your money to work. Making the most out of what you have.

Personally, I’m in the wealth maximisation camp. My motivation behind investing is to create financial margin, and this has made two major events in my life far easier financially. I want to share my experience in the hope it encourages others to set themselves up with financial margin.

Event number 1: Moving to the other side of the world and back

With a freshly minted marriage, my wife Belinda and I started plans to move overseas for a couple of years. You know, the typical London stint. We arrived in a chilly November and went to work on finding a job. After a couple of months of job hunting, travelling and settling into London life, I landed a job at Barclays bank.

Life was great! A new job, lots of fun travel, just the two of us and a neat little setup in Putney with a growing group of friends.

Not long after we moved to sunny England we got the call that Belinda’s mum had been given just three to four months to live.

While that journey is a story in itself, maybe for another time, here’s where the need for financial margin started to kick in. Imagine not even having to think twice about booking the next flight to Australia, incidentals, being out of work for a period, moving back across the world and so on. All of our energy could be spent on helping her mum and family through this tough time, and on supporting each other.

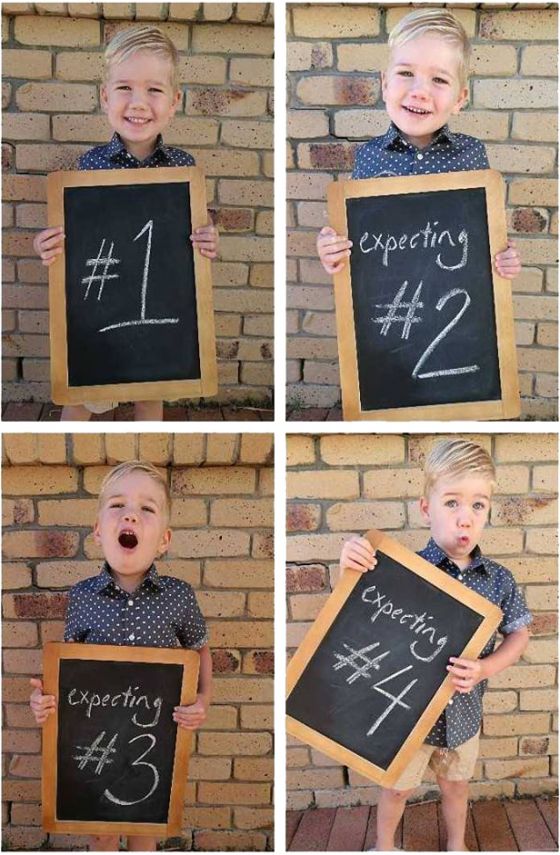

Event number 2: Triplets! Whaaaaat!

A few years on and we have an amazing three-year-old son who would love a little brother or sister to play with. You can imagine our joy when our doctor congratulated us and told us we would have another baby. You can probably also imagine the surprise when we heard him say “Hang on, there’s a second heartbeat in there…. Oh wait….” My life had already flown past my eyes at the thought of twins, so when the doctor said “oh wait,” I just started laughing. I figured it must have been a quirky doctor gag. “I wouldn’t joke about this,” he said. “There are three little babies in there.”

Holy crap. (Actual language edited)

Here’s the thing about triplets, it’s not just the fact that they outnumber arms, breasts, parents and almost everything else that would normally match up, they’re also triple (at least) the cost of having a single baby. The shopping list includes: a new car (well, van, actually), three cots, a triplet pram (they’re more than triple the price of a single pram, for some reason) and somewhere between 150 and 200 nappies per week! I could go on but that’s not the point of this post.

When we got the news, whether we could afford it or not wasn’t the first, second or third consideration. In fact, other than my moaning about having to liquidate some stocks earlier than I wanted to, the truth of the matter is that we’ll get through fine financially. While it will blow a big hole in our budget, it’s not going to be devastating and we can provide for the triplets to the level that we choose.

The points is, life happens! Things don’t go to plan, sometimes it can be devastating, sometimes amazing but we can’t plan for either. So, financial margin may ensure you get out of it with your sanity, your relationships and your financial security.

If you’re just starting out and want to create financial margin for your own life, check out my guide on how to start investing with nothing.

For more on creating financial margin, sign up to our Investor Hub newsletter below and follow us on Facebook and Twitter.

About Josh Callaghan

Canstar’s General Manager for Wealth, Josh Callaghan,is the former General Manager of Wealth at Canstar and co-founder of Fintech Queensland. In his role at Canstar, Josh was responsible for the strategic direction, operations and commercial outcomes of the Wealth division, which includes Superannuation and Investments. He has over 19 years of experience in product management, strategy, technology and marketing in the financial services industry.

Share this article