Did you know that your Afterpay habits could affect your credit score?

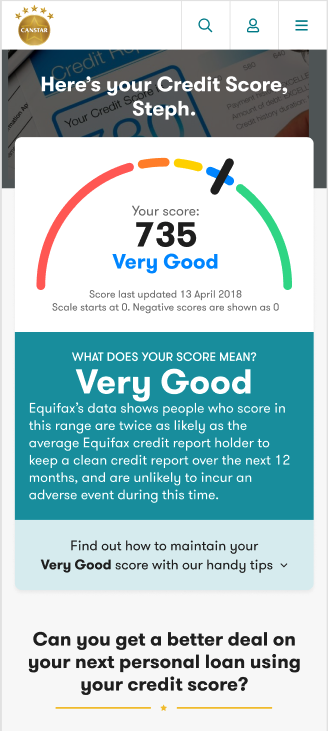

There are many factors that can go into calculating your credit score, including a number of things that could be affecting it for the worse. Having a good credit score is important as it can affect your ability to take out credit products such as credit cards, personal loans or a home loan in the future. A good credit score may also mean getting access to lower interest rates in some situations.

Here are 10 things to avoid if you want to maintain a healthy credit score:

- Missing your credit or loan repayments

- Paying your bills late

- Making too many applications for credit

- Missing your Afterpay or other ‘Buy Now, Pay Later’ payments

- Payday loans

- Applying for balance transfers too often

- Court judgments

- Forgetting to update your contact details

- Not fixing errors on your credit report

- Not regularly checking your credit report

1. Missing your credit or loan repayments

Missing your repayments can have a pretty significant impact on your credit score. According to Experian’s 2019 Know Your Score report, your credit score can drop by 22% if you miss just one credit card repayment (even if you never missed any repayments prior) and a massive 42% if you miss three or more credit card repayments within three months. You are considered to have missed a payment if you make the payment more than 14 days late. This can be recorded on your credit report and it will stay there for two years.

If you are more than 60 days late and the payment is more than $150, then a default may be listed on your report. The credit provider will need to have taken steps to collect the debt before this, including contacting you to let you know about it and request payment. A default will remain on your report for five years.

2. Paying your bills late

It’s also important to keep on top of your phone and electricity bills. Although telco and utility companies cannot provide information about your repayment history, they can provide information about defaults.

You might want to schedule automatic payments to help pay your bills on time. You can also try Canstar’s budgeting calculator if you need help managing your expenses.

3. Making too many applications for credit

If you shop around for credit and apply to multiple credit providers within a short timeframe, this can lower your credit score. An enquiry is added to your report each time you apply for credit and the credit provider gets a copy of your report. These enquiries stay on your report for five years.

If a lot of enquiries are recorded on your report in a short period of time, this flags you as a greater risk to lenders and it may indicate that you are in credit stress. Applications for credit can include credit cards, loans as well as some ‘Buy Now, Pay Later’ (BNPL) services like Afterpay.

4. Missing your Afterpay or other ‘Buy Now, Pay Later’ payments

Falling behind on your Afterpay or other BNPL payments can also be bad for your credit score. Most BNPL providers can report any negative activity on your account (such as missed repayments or defaults) to credit reporting agencies.

5. Payday loans

Applying for a payday loan may also have a negative impact on your credit score. When calculating your credit score, credit reporting bodies generally look at the type of providers you have applied for credit with. There may be different levels of risk given to applying for a loan with a payday lender compared to a bank.

Payday loans can also come with large fees – lenders may charge you an establishment fee of up to 20% and a monthly service fee of up to 4% of the amount borrowed, according to Moneysmart. So consider your options carefully and see if there are any cheaper ways to access money if you need it.

6. Applying for balance transfers too often

Each time you apply for a credit card with a balance transfer offer, it will be added to your credit report. If you try to shift your credit card balance around and apply for multiple balance transfer offers, this can harm your credit score. If you have already transferred your balance once, Moneysmart says it may be better to try to pay off your credit card balance rather than transferring it again.

7. Court judgments

Court judgments against you will be listed on your credit report. This can flag you as an increased risk and can negatively impact your credit score. Court judgments stay on your credit file for five years from the date of the judgment.

Filing for bankruptcy can also lower your credit score. This will remain on your report five years from the date you became bankrupt or two years from the date you were no longer bankrupt (whichever is later).

8. Forgetting to update your contact details

Although this one may seem harmless, it can be an easy way to hurt your credit score. Make sure you let your lenders, phone and utility companies know if you move house so they can re-direct any bills to your new address. If you don’t pay these bills on time, Equifax says you could end up with a credit infringement or overdue debt listed on your report.

9. Not fixing errors on your credit report

When you are checking your credit report, it’s important to make sure that all the information (such as your personal details and the loans and debts listed) are correct. If you think something is wrong, you can contact your credit provider or the credit reporting body and ask them to fix it.

This is free to do. Be careful of companies that try to charge you to “repair” your credit report. You cannot remove information on your report that is correct (even negative information).

10. Not regularly checking your credit report

To that end, it’s a good idea to regularly check your credit report and make sure the information is correct. You can get a copy of your credit report from a credit reporting body, such as Equifax, Experian and Illion. You can typically get a free copy once a year.

You can check your credit score as often as you like, so you might want to do this regularly as well. Canstar offers a free credit score checker, through which you can check your score each month.

If you are finding it difficult to manage your bills or loan repayments, you can ask your lender or service provider for financial hardship assistance. You might also want to contact a financial counsellor for help. You can speak to a financial counsellor for free by calling the National Debt Helpline on 1800 007 007.

This article was reviewed by our Sub Editor Tom Letts and Finance Editor Sean Callery before it was updated, as part of our fact-checking process.

Main image source: Kite_rin (Shutterstock).

Follow Canstar on Facebook and Twitter for regular financial updates.

Thanks for visiting Canstar, Australia’s biggest financial comparison site*

→ Looking to find a better deal? Compare car insurance, car loans, health insurance, credit cards, life insurance and home loans with Canstar. You can also check your credit score for free.

This content was reviewed by Sub Editor Tom Letts and Editor-in-Chief Nina Tovey as part of our fact-checking process.

Share this article